Verify your earlier years defective Income tax return and remove the defect | One time relaxation till 30.09.2020

Many a times people just file the return themselves online or using some online tool and are not aware that they even need to verify the return or send it to CPC Bangalore after signing the ITR V or many a times the professional has so many returns to file that he forgets to verify some of them and which in turn makes them defective.

Why is verification of Income Tax return important?

There are cases where assessee gets his/ her return filed by other professional or using some online portal or even sometimes they are unaware is someone is having their id password of e filing website and hence the Income tax department has made this rule that once a person files his return, it needs to be verified by the person, so that they know that person is aware about the return being filed and only after verification the return shall be processed.

If the return is not verified within 120 days of filing return of income the same shall become defective u/s 139(9). Once the return becomes defective it is as good as one has not filed the return.

There are mainly 5 ways of verifying your Income tax return:

1. By digitally signing the ITR at the time of filing the same. (Digital signature cannot be made after filing the return).

2. By Aadhar OTP.

3. By Bank account number.

4. By Demat account number.

5. By sending the signed copy of ITR V to CPC Bangalore.

Now, from AY 2020-21 Income tax department has made it more mandatory to verify the return and only after that you will get ITR V. You can read more on same HERE.

CBDT has issued a circular to provide a one time relaxation to people whose return are defective because of non verification wherein by virtue of circular, earlier assessee had to sign the ITR V and send it to CPC, Bangalore, but now they have even activated a tab in e-filing portal and can verify the return.

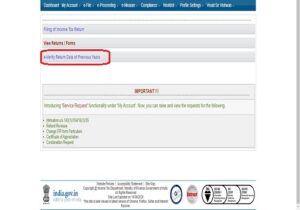

As soon as you log in to e-filing portal you will see this option on the home screen.

The relaxation has been granted for A.Y. 2015-16 to A.Y. 2019-20.

To read the full Circular CLICK HERE.