CBIC issued 7 notifications in 1 day on 03.04.2020 which clarifies various relief which was provided by Finance Minister on 24.03.2020, Let’s understand the meaning of each notification one by one:

Notification 30/2020: Seeks to extend time limit for opting composition scheme for F.Y. 2020-21 till 30.06.2020 and to apply the rule 36 for taking ITC upto 10% credit of eligible credit for invoices not uploaded on portal in a cumulative manner for period February, March, April, May, June, July and August, 2020 in GSTR 3B of September, 2020.

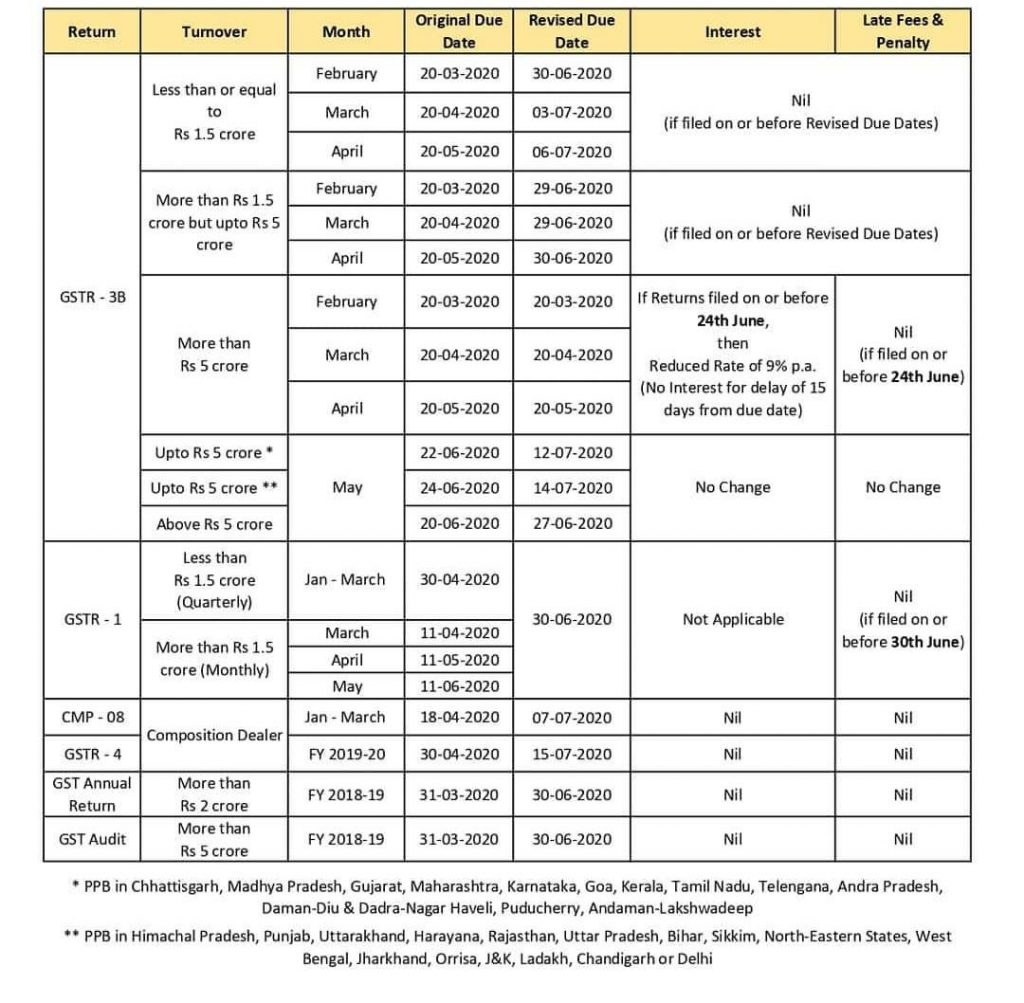

Notification 31/2020: Seeks to waive interest on late payment of tax in case where turnover is below 5 crores and return is filed within due time as mentioned in the notification which is different for different turnover and in case of turnover exceeding 5 crore the due date will remain same. However no interest needs to be paid if return filed within 15 days of due date and after that they need to pay reduced interest rate of 9% if return filed within 24.06.2020.

Notification 32/2020: Waiver of late fees if GSTR 3B if return filed within new dates mentioned in notification 32/2020.

Notification 33/2020: Waiver of late fees for GSTR 1 of March, April, May 2020 or for quarter ending March 2020 if filed till 30.06.2020.

Notification 34/2020: Seeks to extend due date of furnishing FORM GST CMP-08 (composition dealer return) for the quarter ending March, 2020 till 07.07.2020 and filing FORM GSTR-4 for FY 2019-20 till 15.07.2020

Notification 35/2020: This notification amend due date for all the compliance which are due between 20.03.2020 to 29.06.2020 till 30.06.2020 except: [ Chapter IV (value of supply), section 10(3) (Composition levy), section 25 (process of registration), section 27 (Special provisions relating to casual taxable person and non-resident taxable person.), section 31 (tax invoice), section 37 (furnishing details of outward supply), section 47 (levy of late fees), section 50 (interest on delayed payment of tax), section 69 (power to arrest), section 90 (liability of partners of firm to pay tax), section 122 (penalty of certain offences) and section 129 (Detention, seizure and release of goods and conveyances in transit.).

Where an e-way bill has been generated under rule 138 of the Central Goods and Services Tax Rules, 2017 and its period of validity expires during the period 20th day of March, 2020 to 15th day of April, 2020, the validity period of such e-way bill shall be deemed to have been extended till the 30th day of April, 2020.

Notification 36/2020: Seeks to amend due date of GSTR 3B for supply made in May, 2020. Summary of same has been included in above image.

Now in none of the notification there has been any specific extension provided to GSTR 7 i.e. GST return for TDS or GSTR 8 i.e. GST return for TCS and in such case we can take help of notification 35/2020 which extends the due date of everything in general except the exceptions mentioned in the notification. Hence it can be said that due date for TDS and TCS return has also been extended.

This article is just for information purpose it is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 6