Submit response to confirm/ revise the refund claim – Why are you getting this mail and how to get refund

Now that due date for filing Income tax return is over for people other than those covered under audit, Income tax department is sending e-mail and messages to people who have claimed refund, to confirm/ revise their refund claim on e-filing portal, so as to confirm that refund claimed by them is genuine and they haven’t filed any revise return after that return in which refund amount has been changed. The E-mail received is as under:

“Dear Taxpayer,

It is seen that a claim of refund has been made in the Income Tax Return for AXXXXXXX8E for AY-2022-23 filed by you on Jul 17, 2022 .

Your income-tax return has been identified under risk management process of the Income-Tax Department. In this context, your confirmation is required on the following claim(s)/deduction(s)/omissions in the return.

Reason: It is seen that you have enhanced deduction under Chapter VI-A in your revised return of income. Verify correctness of deduction under Chapter VI-A claimed in your revised return. And It is seen that you have claimed higher deduction under Chapter VI-A in your return of income compared to the amount reported by your employer in Form 16.

Verify your claim in return of income to maintain consistency with information reported by your employer in TDS return.

This communication is intended to alert you on any possible incorrect claims / omissions in the above-mentioned return of income.

Relevant information in respect of your financial transactions is also available in the Annual Information Statement (AIS) under Services menu in efiling portal, post login. Please check before submitting response in respect of this communication to ensure complete and accurate disclosure of your income.

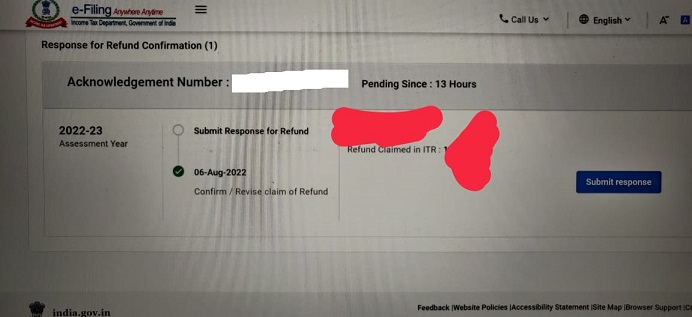

To submit the response, please login to e-Filing portal >>Pending Action >>Worklist>> ‘Response for Refund Confirmation’ and select the correct option.

– The claims in my return of income are correct.

– I will revise my return of income to correct the amount of refund claimed

Please verify the correctness of claims made in your return of income filed and submit your response within 15 days of receipt of this e-mail. In case of any incorrect claims/ omissions, please revise your income-tax return (ITR) for AY 2022-23.”