Recommendations of 53rd GST Council Meeting

GST Council recommends waiving interest and penalties for demand notices issued under Section 73 of the CGST Act (i.e. the cases not involving fraud, suppression or wilful misstatement, etc.) for the fiscal years 2017-18, 2018-19 and 2019-20, if the full tax demanded is paid upto 31.03.2025.

GST Council recommends the time limit to avail input tax credit w.r.t. any invoice or debit note under Section 16(4) of CGST Act, through any GSTR 3B return filed upto 30.11.2021 for FY 2017-18, 2018-19, 2019-20 and 2020-21, may be deemed to be 30.11.2021

Council has recommends monetary limit of Rs. 20 lakh for GST Appellate Tribunal, Rs. 1 crore for High Court and Rs. 2 crore for Supreme Court, for filing of appeals by the Department, to reduce litigation

GST Council recommends reduction of the quantum of pre-deposit required to be paid for filing of appeals under GST

GST Council recommends amending provisions of CGST Act to provide that the three-month period for filing appeals in GST Appellate Tribunal will start from a date to be notified by the Government

To ease the interest burden of the taxpayers, GST Council recommends to not levy interest u/s 50 of CGST Act in case of delayed filing of return, on the amount which is available in Electronic Cash Ledger (ECL) on the due date of filing of the said return

GST Council recommends sunset clause from April 1st, 2025 for receipt of any new application for Anti-profiteering

GST Council recommends exemption from Compensation Cess leviable on the imports in SEZ by SEZ Unit/developer for authorised operations from 1st July, 2017

GST Council recommends 12% GST on milk cans (steel, iron, aluminum) irrespective of use; Carton, Boxes And Cases of both corrugated and non-corrugated paper or paper-board; Solar cookers whether single or dual energy source; and sprinklers including fire water sprinklers.

GST Council recommends exemption of certain services provided by Indian Railways to common man and also intra railway supplies

GST Council recommends certain exemptions related to accommodation services, providing relief to students and working professionals

GST Council recommends to roll-out the biometric-based Aadhaar authentication of registration applicants on pan-India basis in a phased manner

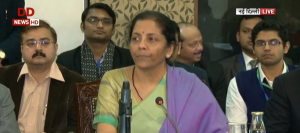

The 53rd GST Council met under the Chairpersonship of Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman in New Delhi today. The meeting was also attended by Union Minister of State for Finance Shri Pankaj Chaudhary, Chief Ministers of Goa and Meghalaya; Deputy Chief Ministers of Bihar, Haryana, Madhya Pradesh, and Odisha; besides Finance Ministers of States & UTs (with legislature) and senior officers of the Ministry of Finance & States/ UTs.

The GST Council inter alia made the following recommendations relating to changes in GST tax rates, measures for facilitation of trade and measures for streamlining compliances in GST.

- Changes in GST Tax Rates:

I. Recommendations relating to GST rates on Goods

A. Changes in GST rates of goods

- A uniform rate of 5% IGST will apply to imports of ‘Parts, components, testing equipment, tools and tool-kits of aircrafts, irrespective of their HS classification to provide a fillip to MRO activities subject to specified conditions.

- All milk cans (of steel, iron and aluminium) irrespective of their use will attract 12% GST.

- GST rate on ‘carton, boxes and cases of both corrugated and non-corrugated paper or paper-board’ (HS 4819 10; 4819 20) to be reduced from 18% to 12%.

- All solar cookers whether single or dual energy source, will attract 12% GST.

- To amend existing entry covering Poultry keeping Machinery attracting 12% GST to specifically incorporate “parts of Poultry keeping Machinery” and to regularise past practice on ‘as is where is’ basis in view of genuine interpretational issues.

- To clarify that all types of sprinklers including fire water sprinklers will attract 12% GST and to regularise the past practice on ‘as is where is’ basis in view of genuine interpretational issues.

- To extend IGST exemption on imports of specified items for defence forces for a further period of five years till 30th June, 2029.

- To extend IGST exemption on imports of research equipment/buoys imported under the Research Moored Array for African-Asian-Australian Monsoon Analysis and Prediction (RAMA) programme subject to specified conditions.

- To exempt Compensation Cess on the imports in SEZ by SEZ Unit/developers for authorised operations w.e.f. 01.07.2017.

Other Miscellaneous Changes

- To exempt Compensation cess on supply of aerated beverages and energy drinks to authorised customers by Unit Run Canteens under Ministry of Defence.

- To provide Adhoc IGST exemption on imports of technical documentation for AK-203 rifle kits imported for Indian Defence forces.

II. Recommendations relating to GST rates on services

- To exempt the services provided by Indian Railways to general public, namely, sale of platform tickets, facility of retiring rooms/waiting rooms, cloak room services and battery-operated car services and to also exempt the Intra-Railway transactions. The issue for the past period will be regularized from 20.10.2023 to the date of issue of exemption notification in this regard.

- To exempt GST on the services provided by Special Purpose Vehicles (SPV) to Indian Railway by way of allowing Indian Railway to use infrastructure built & owned by SPV during the concession period and maintenance services supplied by Indian Railways to SPV. The issue for the past will be regularized on ‘as is where is’ basis for the period from 01.07.2017 till the date of issue of exemption notification in this regard.

- To create a separate entry in notification No. 12/2017- CTR 28.06.2017 under heading 9963 to exempt accommodation services having value of supply of accommodation up to Rs. 20,000/- per month per person subject to the condition that the accommodation service is supplied for a minimum continuous period of 90 days. To extend similar benefit for past cases.

Other changes relating to Services

- Co-insurance premium apportioned by lead insurer to the co-insurer for the supply of insurance service by lead and co-insurer to the insured in coinsurance agreements, may be declared as no supply under Schedule III of the CGST Act, 2017 and past cases may be regularized on ‘as is where is’ basis.

- Transaction of ceding commission/re-insurance commission between insurer and re-insurer may be declared as no supply under Schedule III of CGST Act, 2017 and past cases may be regularized on ‘as is where is’ basis.

- GST liability on reinsurance services of specified insurance schemes covered by Sr. Nos. 35 & 36 of notification No. 12/2017-CT (Rate) dated 28.06.2017 may be regularized on ‘as is where is’ basis for the period from 01.07.2017 to 24.01.2018.

- GST liability on reinsurance services of the insurance schemes for which total premium is paid by the Government that are covered under Sr. No. 40 of notification No. 12/2017-CTR dated 28.06.2017 may be regularized on ‘as is where is’ basis for the period from 01.07.2017 to 26.07.2018.

- To issue clarification that retrocession is ‘re-insurance of re-insurance’ and therefore, eligible for the exemption under Sl. No. 36A of the notification No. 12/2017-CTR dated 28.06.2017.

- To issue clarification that statutory collections made by Real Estate Regulatory Authority (RERA) are exempt from GST as they fall within the scope of entry 4 of No.12/2017-CTR dated 28.06.2017.

- To issue clarification that further sharing of the incentive by acquiring bank with other stakeholders, where the sharing of such incentive is clearly defined under Incentive scheme for promotion of RuPay Debit Cards and low value BHIM-UPI transactions and is decided in the proportion and manner by NPCI in consultation with the participating banks is not taxable.

B. Measures for facilitation of trade:

1. Insertion of Section 128A in CGST Act, to provide for conditional waiver of interest or penalty or both, relating to demands raised under Section 73, for FY 2017-18 to FY 2019-20 : Considering the difficulties faced by the taxpayers, during the initial years of implementation of GST, the GST Council recommended, waiving interest and penalties for demand notices issued under Section 73 of the CGST Act for the fiscal years 2017-18, 2018-19 and 2019-20, in cases where the taxpayer pays the full amount of tax demanded in the notice upto 31.03.2025. The waiver does not cover demand of erroneous refunds. To implement this, the GST Council has recommended insertion of Section 128A in CGST Act, 2017.

2. Reduction of Government Litigation by Fixing monetary limits for filing appeals under GST: The Council recommended to prescribe monetary limits, subject to certain exclusions, for filing of appeals in GST by the department before GST Appellate Tribunal, High Court, and Supreme Court, to reduce government litigation. The following monetary limits have been recommended by the Council:

GSTAT: Rs. 20 lakhs

High Court: Rs. 1 crore

Supreme Court: Rs. 2 crores

3. Amendment in Section 107 and Section 112 of CGST Act for reducing the amount of pre-deposit required to be paid for filing of appeals under GST: The GST Council recommended reducing the amount of pre-deposit for filing of appeals under GST to ease cash flow and working capital blockage for the taxpayers. The maximum amount for filing appeal with the appellate authority has been reduced from Rs. 25 crores CGST and Rs. 25 crores SGST to Rs. 20 crores CGST and Rs. 20 crores SGST. Further, the amount of pre-deposit for filing appeal with the Appellate Tribunal has been reduced from 20% with a maximum amount of Rs. 50 crores CGST and Rs. 50 crores SGST to 10 % with a maximum of Rs. 20 crores CGST and Rs. 20 crores SGST.

4. Applicability of Goods and Services Tax on Extra Neutral Alcohol (ENA) Taxation of ENA under GST: The GST Council, in its 52nd meeting, had recommended to amend GST Law to explicitly exclude rectified spirit/Extra Neutral Alcohol (ENA) from the scope of GST when supplied for manufacturing alcoholic liquors for human consumption. The GST Council now recommended amendment in sub-section (1) of Section 9 of the CGST Act, 2017 for not levying GST on Extra Neutral Alcohol used for manufacture of alcoholic liquor for human consumption.

5. Reduction in rate of TCS to be collected by the ECOs for supplies being made through them: Electronic Commerce Operators (ECOs) are required to collect Tax Collected at Source (TCS) on net taxable supplies under Section 52(1) of the CGST Act. The GST Council has recommended to reduce the TCS rate from present 1% (0.5% CGST + 0.5% SGST/ UTGST, or 1% IGST) to 0.5 % (0.25% CGST + 0.25% SGST/UTGST, or 0.5% IGST), to ease the financial burden on the suppliers making supplies through such ECOs.

6. Time for filing appeals in GST Appellate Tribunal: The GST Council recommended amending Section 112 of the CGST Act, 2017 to allow the three-month period for filing appeals before the Appellate Tribunal to start from a date to be notified by the Government in respect of appeal/ revision orders passed before the date of said notification. This will give sufficient time to the taxpayers to file appeal before the Appellate Tribunal in the pending cases.

7. Relaxation in condition of section 16(4) of the CGST Act:

a) In respect of initial years of implementation of GST, i.e., financial years 2017-18, 2018-19, 2019-20 and 2020-21:

The GST Council recommended that the time limit to avail input tax credit in respect of any invoice or debit note under Section 16(4) of CGST Act, through any return in FORM GSTR 3B filed upto 30.11.2021 for the financial years 2017-18, 2018-19, 2019-20 and 2020-21, may be deemed to be 30.11.2021. For the same, requisite amendment in section 16(4) of CGST Act, retrospectively, w.e.f. 01.07.2017, has been recommended by the Council.

b) with respect to cases where returns have been filed after revocation:

The GST Council recommended retrospective amendment in Section 16(4) of CGST Act, to be made effective from July 1st, 2017, to conditionally relax the provisions of section 16(4) of CGST Act in cases where returns for the period from the date of cancellation of registration/ effective date of cancellation of registration till the date of revocation of cancellation of the registration, are filed by the registered person within thirty days of the order of revocation.

8. Change in due date for filing of return in FORM GSTR-4 for composition taxpayers from 30th April to 30th June: The GST Council recommended an amendment in clause (ii) of sub-rule (1) of Rule 62 of CGST Rules, 2017 and FORM GSTR-4 to extend the due date for filing of return in FORM GSTR-4 for composition taxpayers from 30th April to 30th June following the end of the financial year. This will apply for returns for the financial year 2024-25 onwards. The same would give more time to the taxpayers who opt to pay tax under composition levy to furnish the said return.

9. Amendment of Rule 88B of CGST Rules, 2017 in respect of interest under Section 50 of CGST Act on delayed filing of returns, in cases where the credit is available in Electronic Cash Ledger (ECL) on the due date of filing the said return: The GST Council recommended amendment in rule 88B of CGST Rules to provide that an amount, which is available in the Electronic Cash Ledger on the due date of filing of return in FORM GSTR-3B, and is debited while filing the said return, shall not be included while calculating interest under section 50 of the CGST Act in respect of delayed filing of the said return.

10. Insertion of Section 11A in CGST Act for granting power not to recover duties not levied or short-levied as a result of general practice under GST Acts: The GST Council recommended inserting a new Section 11A in CGST Act to give powers to the Government, on the recommendations of the Council, to allow regularization of non-levy or short levy of GST, where tax was being short paid or not paid due to common trade practices.

11. Refund of additional Integrated Tax (IGST) paid on account of upward revision in price of the goods subsequent to export: The GST Council recommended to prescribe a mechanism for claiming refund of additional IGST paid on account of upward revision in price of the goods subsequent to their export. This will facilitate a large number of taxpayers, who are required to pay additional IGST on account of upward revision in price of the goods subsequent to export, in claiming refund of such additional IGST.

12. Clarification regarding valuation of supply of import of services by a related person where recipient is eligible to full input tax credit: The Council recommended to clarify that in cases where the foreign affiliate is providing certain services to the related domestic entity, for which full input tax credit is available to the said related domestic entity, the value of such supply of services declared in the invoice by the said related domestic entity may be deemed as open market value in terms of second proviso to rule 28(1) of CGST Rules. Further, in cases where full input tax credit is available to the recipient, if the invoice is not issued by the related domestic entity with respect to any service provided by the foreign affiliate to it, the value of such services may be deemed to be declared as Nil, and may be deemed as open market value in terms of second proviso to rule 28(1) of CGST Rules.

13. Clarification regarding availability of Input Tax Credit (ITC) on ducts and manholes used in the network of Optical Fiber Cables (OFCs): The Council recommended to clarify that input tax credit is not restricted in respect of ducts and manhole used in network of optical fiber cables (OFCs), under clause (c) or under clause (d) of sub-section (5) of section 17 of CGST Act.

14. Clarification on the place of supply applicable for custodial services provided by banks: The Council recommended to clarify that place of supply of Custodial services supplied by Indian Banks to Foreign Portfolio Investors is determinable as per Section 13(2) of the IGST Act, 2017.

15. Clarification on valuation of corporate guarantee provided between related persons after insertion of Rule 28(2) of CGST Rules, 2017: GST Council recommended amendment of rule 28(2) of CGST Rules retrospectively with effect from 26.10.2023 and issuance of a circular to clarify various issues regarding valuation of services of providing corporate guarantees between related parties. It is inter alia being clarified that valuation under rule 28(2) of CGST Rules would not be applicable in case of export of such services and also where the recipient is eligible for full input tax credit.

16. Clarification regarding applicability of provisions of Section 16 (4) of CGST Act, 2017, in respect of invoices issued by the recipient under Reverse Charge Mechanism (RCM): The Council recommended to clarify that in cases of supplies received from unregistered suppliers, where tax has to be paid by the recipient under reverse charge mechanism (RCM) and invoice is to be issued by the recipient only, the relevant financial year for calculation of time limit for availment of input tax credit under the provisions of section 16(4) of CGST Act is the financial year in which the invoice has been issued by the recipient.

17. Clarification on following issues to provide clarity to trade and tax officers and to reduce litigation:

- Clarification on taxability of re-imbursement of securities/shares as ESOP/ESPP/RSU provided by a company to its employees

- Clarification on requirement of reversal of input tax credit in respect of amount of premium in Life Insurance services, which is not included in the taxable value as per Rule 32(4) of CGST Rules.

- Clarification on taxability of wreck and salvage values in motor insurance claims

- Clarification in respect of Warranty/ Extended Warranty provided by Manufacturers to the end customers

- Clarification regarding availability of input tax credit on repair expenses incurred by the insurance companies in case of reimbursement mode of settlement of motor vehicle insurance claims.

- Clarification on taxability of loans granted between related person or between group companies.

- Clarification on time of supply on Annuity Payments under HAM Projects.

- Clarification regarding time of supply in respect of allotment of Spectrum to Telecom companies in cases where payment of licence fee and Spectrum usage charges is to be made in instalments.

- Clarification relating to place of supply of goods supplied to unregistered persons, where delivery address is different from the billing address

- Clarification on mechanism for providing evidence by the suppliers for compliance of the conditions of Section 15(3)(b)(ii) of CGST Act, 2017 in respect of post-sale discounts, to the effect that input tax credit has been reversed by the recipient on the said amount.

- Clarifications on various issues pertaining to special procedure for the manufacturers of the specified commodities, like pan masala, tobacco etc.

18. The Council recommended amendment in section 140(7) of CGST Act retrospectively w.e.f. 01.07.2017 to provide for transitional credit in respect of invoices pertaining to services provided before appointed date, and where invoices were received by Input Service Distributor (ISD) before the appointed date.

19. The Council recommended providing a new optional facility by way of FORM GSTR-1A to facilitate the taxpayers to amend the details in FORM GSTR-1 for a tax period and/ or to declare additional details, if any, before filing of return in FORM GSTR-3B for the said tax period. This will facilitate taxpayer to add any particulars of supply of the current tax period missed out in reporting in FORM GSTR-1 of the said tax period or to amend any particulars already declared in FORM GSTR-1 of the current tax period (including those declared in IFF, for the first and second months of a quarter, if any, for quarterly taxpayers), to ensure that correct liability is auto-populated in FORM GSTR-3B.

20. The Council recommended that filing of annual return in FORM GSTR-9/9A for the FY 2023-24 may be exempted for taxpayers having aggregate annual turnover upto two crore rupees.

21. Amendment was recommended to be made in section 122(1B) of CGST Act retrospectively w.e.f. 01.10.2023, so as to clarify that the said penal provision is applicable only for those e-commerce operators, who are required to collect tax under section 52 of CGST Act, and not for other e-commerce operators.

22. The Council recommended amendment in rule 142 of CGST Rules and issuance of a circular to prescribe a mechanism for adjustment of an amount paid in respect of a demand through FORM GST DRC-03 against the amount to be paid as pre-deposit for filing appeal.

Other measures pertaining to Law and Procedures

23. Rolling out of bio-metric based Aadhaar authentication on All-India basis: The GST Council recommended to roll-out the biometric-based Aadhaar authentication of registration applicants on pan-India basis in a phased manner. This will strengthen the registration process in GST and will help in combating fraudulent input tax credit (ITC) claims made through fake invoices.

24. Amendments in Section 73 and Section 74 of CGST Act, 2017 and insertion of a new Section 74A in CGST Act, to provide for common time limit for issuance of demand notices and orders irrespective of whether case involves fraud, suppression, willful misstatement etc., or not: Presently, there is a different time limit for issuing demand notices and demand orders, in cases where charges of fraud, suppression, willful misstatement etc., are not involved, and in cases where those charges are involved. In order to simplify the implementation of those provisions, the GST Council recommended to provide for a common time limit for issuance of demand notices and orders in respect of demands for FY 2024-25 onwards, in cases involving charges of fraud or willful misstatement and not involving the charges of fraud or willful misstatement etc. Also, the time limit for the taxpayers to avail the benefit of reduced penalty, by paying the tax demanded along with interest, has been recommended to be increased from 30 days to 60 days.

25. The Council recommended amendment in section 171 and section 109 of CGST Act, 2017 to provide a sunset clause for anti-profiteering under GST and to provide for handling of anti-profiteering cases by Principal bench of GST Appellate Tribunal (GSTAT). Council has also recommended the sun-set date of 01.04.2025 for receipt of any new application regarding anti-profiteering.

26. Amendment in Section 16 of IGST Act and section 54 of CGST Act to curtail refund of IGST in cases where export duty is payable: The Council recommended amendments in section 16 of IGST Act and section 54 of CGST Act to provide that the refund in respect of goods, which are subjected to export duty, is restricted, irrespective of whether the said goods are exported without payment of taxes or with payment of taxes, and such restrictions should also be applicable, if such goods are supplied to a SEZ developer or a SEZ unit for authorized operations.

27. The threshold for reporting of B2C inter-State supplies invoice-wise in Table 5 of FORM GSTR-1 was recommended to be reduced from Rs 2.5 Lakh to Rs 1 Lakh.

28. The Council recommended that return in FORM GSTR-7, to be filed by the registered persons who are required to deduct tax at source under section 51 of CGST Act, is to be filed every month irrespective of whether any tax has been deducted during the said month or not. It has also been recommended that no late fee may be payable for delayed filing of Nil FORM GSTR-7 return. Further, it has been recommended that invoice-wise details may be required to be furnished in the said FORM GSTR-7 return.

Note: The recommendations of the GST Council have been presented in this release containing major item of decisions in simple language for information of the stakeholders. The same would be given effect through the relevant circulars/ notifications/ law amendments which alone shall have the force of law.

To read the Press Release CLICK ME.