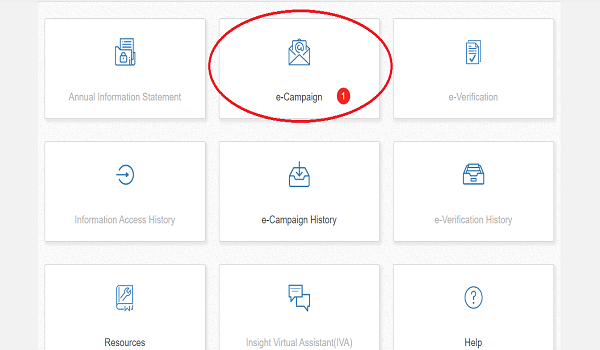

As we know CBTD has started using Compliance portal extensively for sending alerts to assessee regarding some high value transaction or non filing of return etc.

Recently we had seen CBDT sending messages related to high value transaction to various assessee which was nothing but details of GSTR 1 sales and interest income.

Now the case is different although people are still receiving the notice for high value transaction but earlier the notice was for FY 2020-21 and now the people are receiving notice for not mentioning high value transaction in Income tax return for FY 2019-20.

The people have been receiving high value transaction notices majorly for not showing interest income earned on savings account or FD etc.

The issue has mainly arisen as people either didn’t disclose full income to their tax professional or were using some online software without human intervention where return is filed only with information available. Hence it’s always better to choose service of professional for better compliance. If you wish to file your income tax return with professional CLICK HERE and book your slot.

Now the issue people are facing is that they have received such notice on or after 01.04.2021 and due date for revising the return for FY 2019-20 was 31.03.2021 and hence people now cannot revise the return.

Hence, there are only two options available as of now:

- To pay appropriate tax on relevant amount along with interest and penalty.

- To apply before Pr. CIT and request for condonation to file Income tax return u/s 119(2)(b).

However, it is always advisable to first take service of a practicing Chartered accountant or tax professional to take appropriate course of action to pay tax and file reply against compliance notice.

If you need consultation with tax expert, you can book the same by CLICKING HERE.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 3