Penalty for holding multiple PAN card: Rs. 10,000 u/s 272B

Owning a PAN card is responsibility in itself as it contains your tax related information on which the tax officials of our country rely. However, many a times people out of mistake or intentionally hold 2 or multiple PAN card’s which is a crime and attracts penalty of Rs. 10,000/- u/s 272B of the Income Tax act which many people are not aware of.

Section 272B(1) of the Income Tax act is as under:

“If a person fails to comply with the provisions of section 139A, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees.”

From the above provision it’s clear that penalty depends on section 139A and as per section 139A(7):

“No person who has already been allotted a permanent account number under the new series shall apply, obtain or possess another permanent account number.”

Hence upon combine reading of above 2 sections we come to know that if a person holds more than one PAN card he can be held liable for a penalty of Rs. 10,000.

There can be various reason for such duplication of PAN card, some of which are as follows:

- Multiple applications: There can be a situation where people unintentionally apply for second PAN card without being aware that a PAN card has already been issued in their name as earlier there was no system to check if a PAN card has been issued to one person earlier or not. Now, with online integration of details and Aadhar becoming important to apply for PAN card it’s difficult to get 2 PAN card for same person.

- Changing details: Many a times it happen that people apply for a PAN card and there are some mistakes in their name or address and rather than applying for correction in details they apply for a new PAN card as they think that if they don’t use the old PAN card it won’t create any harm and therefore they just keep the old PAN card like that without surrendering it.

- Malicious intent: Some people might apply for multiple PANs with an intention to cheat the government or save money. These are blatant violations and will attract a penalty.

Let’s see how you can surrender the duplicate PAN card:

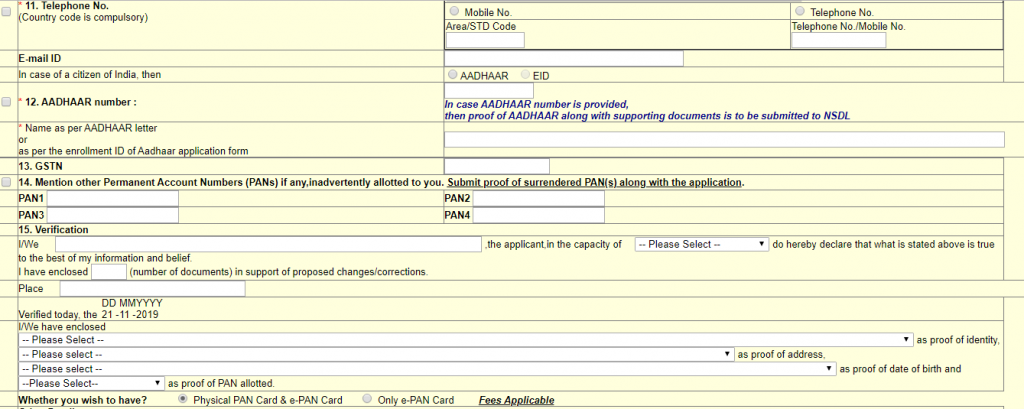

For surrendering the PAN you can use the PAN correction Form available at https://tin.tin.nsdl.com/pan/correctiondsc.html. After clicking on the above link you can open the PAN card application and you must mention the details of PAN card you wish to surrender at point no. 14 and you must also enclose the copy of PAN card along with such application. Once such request is done and processed your duplicate PAN mentioned in above point will become inactive and you won’t be liable for any penalty.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.