As we know if the Income tax return filed by an assessee is not verified by the assessee within 120 days from filing of return in the prescribed same shall be considered as defective and it shall mean that no return has been filed for that year.

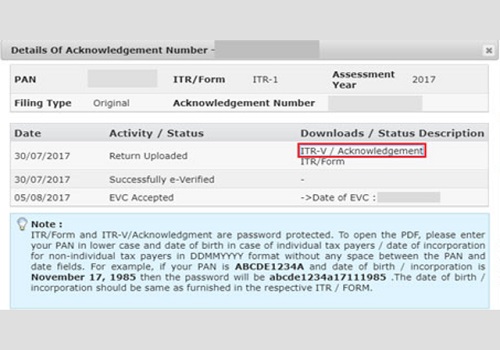

Verification of return is important because unless the return is verified same shall not be processed by the Income Tax department and many people used to use it for just submitting the return before some authority and not processing the same. However now things have changed and now you can’t print ITR-V without verifying same. For more details CLICK HERE.

Now, CBDT has provided a relief to taxpayers for Income tax returns of A.Y. 2015-16, 2016-17, 2017-18, 2018-19, 2019-20 where they can verify the return which was filed within the time limit mentioned under section 139 for the above years by either sending the signed copy to CPC, Bengaluru or E-verifying the same till 30.09.2020.

The above relaxation shall not apply to cases where Income Tax department has already taken recourse, ensuring that the return is filed.

Also, this circular doesn’t permit filing return of income it just permits verifying return of income which have already been filed within the due time mentioned u/s 139.

Further the due date for processing such return u/s 143(1) shall be extended till 31.12.2020. Interest on refund if any shall be calculated as per provision of section 244A(2) and interest on refund shall be calculated from 30.09.2020.

To read full circular CLICK HERE.

This article is just for information purpose and are personal views of the author. It is always advisable to hire a professional for practical execution or you can mail us. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.