There are Lot of Queries with regard to Validation of UDIN by CBDT. From 27th November the CBDT has made it Mandatory to Mention the UDIN alongwith Tax Audit Reports/ Other Forms uploaded on e-filing portal, Either at the time of Uploading the Forms or Update the UDIN within 15 Days from the Filing of the Form. The Tax Reports / Forms will be treated valid only if their UDINs have been validated by CBDT E-filing Portal.

It is being observed that some members though might have generated UDIN for IT Forms well in time but some-how missed to update the same on e-filing portal.

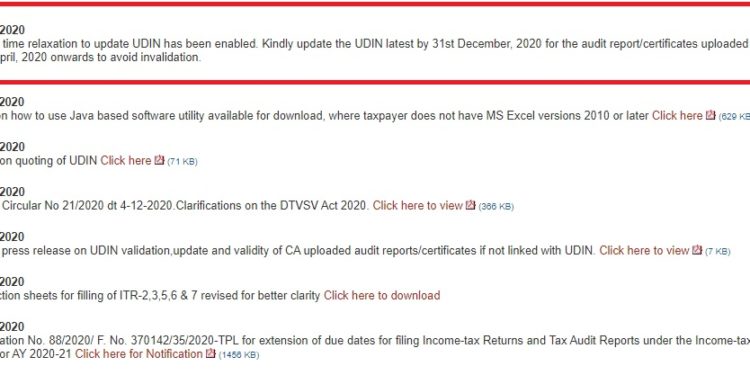

To remove this difficulty the CBDT has given a one-time relaxation by allowing them to update UDINs latest by 31st December, 2020.

In view of the same, such members are requested to update the UDINs on the e-filing Portal at the earliest but not later than 31st December, 2020 for all such IT Forms which have been uploaded by them from 27th April, 2020 onwards till 26th November, 2020.

The procedure to update the UDIN is as under:

Step-1

Login to Income Tax Portal through ARCA Login Credentials

Step-2,

Click on the Tab -> My Account -> View/ Update UDIN

Step-3

Enter PAN No. of the Client

Step-4

Enter UDIN and Press Update UDIN

Also, it is important to mention here that many people were facing difficulties in updating the UDIN later as website was taking such UDIN as invalid UDIN.

It is therefore advisable to mention UDIN in majority cases at the time of filing Form 3CD, Form 15CB or any other report or forms.