Now file Nil GSTR 3B via SMS | This facility is not for Nil GSTR 1

In one of the previous GST council meeting it was announced that a facility would be launched to file Nil GST return by just typing an SMS. However no modus operandi was provided on how one can do that.

Today, CBIC has made a press release wherein they have discussed this modus operandi as to how one can file Nil GST return by just sending an SMS.

It is to be noted that this facility is for filing GSTR 3B and not GSTR 1 and hence one need to still file Nil GSTR 1 online.

In the press release they have mentioned as below:

“In a significant move towards taxpayer facilitation, the Government has today onwards allowed filing of NIL GST monthly return in FORM GSTR-3B through SMS. This would substantially improve ease of GST compliance for over 22 lakh registered taxpayers who had to otherwise log into their account on the common portal and then file their returns every month. Now, these taxpayers with NIL liability need not log on to the GST Portal and may file their NIL returns through a SMS.

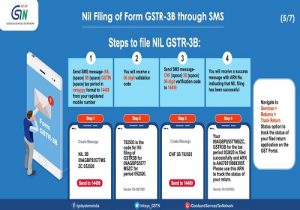

2. For this purpose, the functionality of filing Nil FORM GSTR-3B through SMS has been made available on the GSTN portal with immediate effect. The status of the returns so filed can be tracked on the GST Portal by logging in to GSTIN account and navigating to Services>Returns>Track Return Status. The procedure to file Nil returns by SMS is as follows: –

| Step | SMS to 14409 | Receive from VD-GSTIND |

| Initiate Nil Filing | NIL<space>3B<space>GSTIN<space>Tax period

Ex. NIL 3B 09XXXXXXXXXXXZC 052020 |

123456 is the CODE for Nil filing of GSTR3B for09XXXXXXXXXXXZC for period 052020. Code validity 30 min.

|

| Confirming Nil Filing | CNF <space>3B<space>Code

Ex. CNF 3B 123456 |

Your, 09XXXXXXXXXXXZC, GSTR3B for 052020 is filed successfully and acknowledged vide ARN is AA070219000384. Please use this ARN to track the status of your return. |

| For Help, anytime | HELP<Space>3B

Ex. Help 3B |

To file NIL return of GSTIN for Mar 2020: NIL 3B 07CQZCD1111I4Z7 032020 To confirm Nil filing: CNF 3B CODE More details www.gst.gov.in |

To read full Press release CLICK HERE.

This article is just for information purpose and are personal views of the author. It is always advisable to hire a professional for practical execution or you can mail us. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.