No challan available for making payment of TCS on sale of goods u/s 206C(1H)

Section 206C(1H) – TCS on sale of goods was introduced in Income tax act by Finance Act, 2020 wherein it was mentioned that seller of the goods whose turnover in previous year is above Rs. 10 crore will have to collect TCS on receipt of payment above Rs. 50 lakh from one buyer.

The above section was made effective from 01.10.2020.

However, now a new issue has arisen in this saga. October 2020 was the first month of this provision and the due date for payment of TCS collected in the month is 07.11.2020.

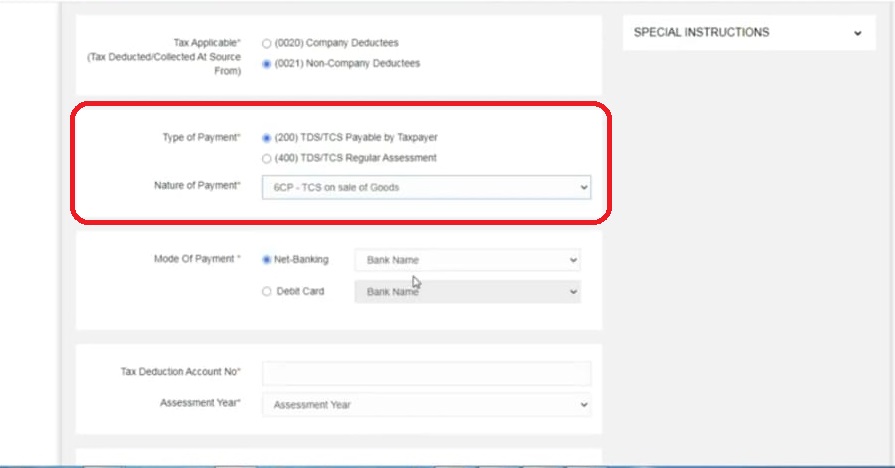

As of now no challan is available to make payment of TCS collected on sale of goods. If you visit Tin-NSDL website which is used to make tax payment you won’t find an option to deposit TCS collected on sale of goods under nature of payment.

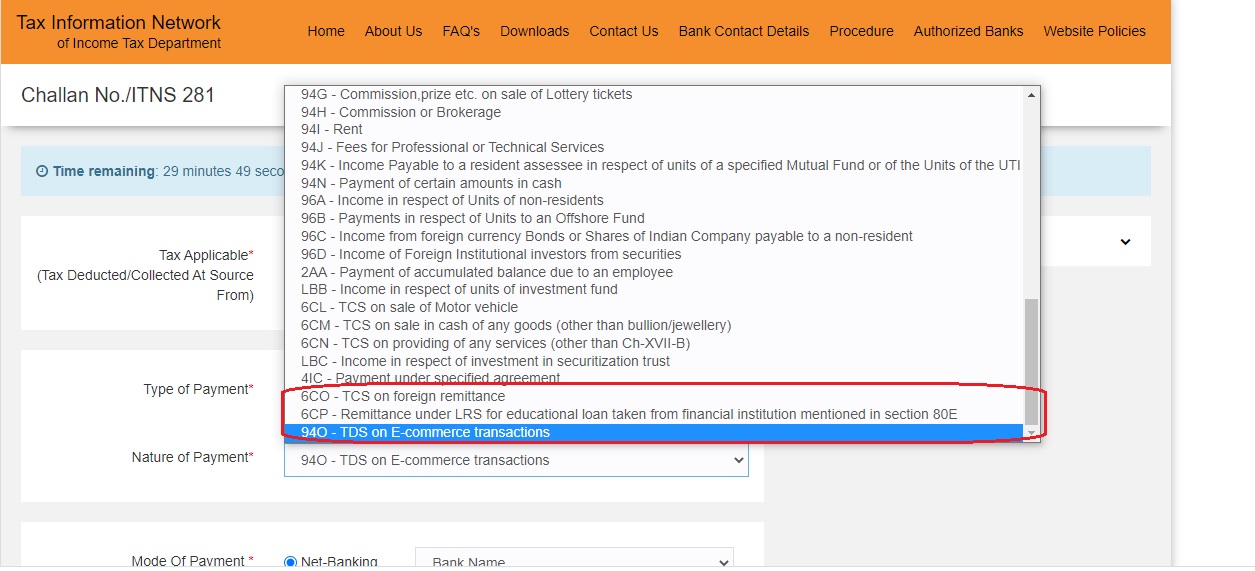

Screenshot for the same is as under:

From the above it can be seen that all other TCS/ TDS provision which were added from 01.10.2020 have been made available above like remittance under LRS scheme, foreign remittance etc but TCS for sale of goods is not available.

From the above it can be seen that all other TCS/ TDS provision which were added from 01.10.2020 have been made available above like remittance under LRS scheme, foreign remittance etc but TCS for sale of goods is not available.

Although TCS for tour operator is also not specifically available but same can be added in TCS on providing any service but this is not even service and hence there is no relevant nature of payment available for this.

A message is being circulated where it is being said that the above option has been added and department is aware of same and it shall be made live soon. The message being circulated is as under:

“Respected users

Department today changed its portal for challan payment of “TCS ON SALE OF GOODS”

As per direction of TRACES please wait for challan payments under this head.

We will revert you when option for payment available on portal.

Thanks“

Till yesterday the website Tin NSDL was showing option to pay TCS on sale of goods at 6CP code but now the same option shows 6CP as Remittance under LRS for education loan taken from financial institution mentioned in section 80E.

It will be interesting to see that if the option is not available till tomorrow will the tax payers bear interest on late payment or will government waive such interest or the tax payer should use some other challan to make the payment and later on settle it against this?

These are the few questions which needs to be answered and you can comment your thought as well on same.