NFRA charges a CA with Rs. 25 lakh penalty for professional misconduct in IL&FS case

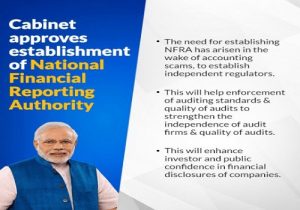

National Financial Reporting Authority (NFRA) is an independent regulator to oversee the auditing profession and accounting standards in India under Companies Act 2013. It came into existence in October 2018.

In a recent judgement of NFRA dt. 22.07.2020 a show cause notice was issued to CA Udayan Sen on 17.01.2020 u/s 132(4) of Companies Act, 2013 asking him to show cause as to why action should not be taken against him for professional misconduct in respect of his performance as Engagement partner in the statutory audit of ILFS financial services Ltd. for the year 2017-18.

On through the order one could find that there were various actions or conducts leading to misconduct:

Audit firm was providing various prohibited services to the auditee or it’s holding company and violating the provisions of section 144 of the Companies Act, 2013.

Thus, the engagement partner CA udayan had failed to exercise due diligence as required under SA 200.

The audit firm was engaged in 15 other non audit services to the company as well as other group companies which was compromising the independent nature of audit.

However CA explained that most of the services were in nature of management advisory and consultancy service and hence permitted.

It was further stated by the CA that the audit firm “provided advice and recommendation to assist management in discharging its responsibilities.

Further it was decided by NFRA that the firm had no approval of the audit committee u/s 144 of the Companies Act, 2013 regarding such non audit services. The services were prohibited u/s 144 of the Companies act and the services give rise to self-review threat.

Also, CA Udayan failed to discharge his responsibility under SA 220 and according to that engagement partner shall take the responsibility of for the overall quality on each audit engagement to which partner is assigned.

The various SA which were violated by engagement partner are as under: SA 200, 220, 230, 240, 250, 260, 315, 570, 580, 700.

RBI had pointed out in its various reports that IFIN was in serious violation of Net owner funds requirement and capital to risk asset ratio.

However, CA udayan sen did not exercise due diligence in communicating such serious and material facts to TCWG and he was grossly negligent in the conduct of his professional duties by not complying with the duties and requirement as mentioned in SA 260.

The audit firm has made reference to certain other International standard instead of audit standards prescribed under section 143(9) and further RBI had asked a report on NPA from the company because as per RBI’s assessment company’s NPA were grossly higher than what were reported and even after having such an evidence the engagement partner did not question NPA which again led to professional misconduct.

Thus, various factors on which penalty was levied on auditor are as under:

1. Loss of Independence of statutory auditor.

2. Compliance with SA’s and maintenance of audit quality.

3. Promotion of public and investor confidence and effectiveness in deterring auditors and audit firms from violating the applicable accounting and auditing standards.

4. Intentional reckless behaviour.

5. Deterrence to Fraud and collusive behaviour.

Based on above misconduct and actions, CA udayan was charged with:

1. A monetary penalty of Rs. 25 lakh.

2. He was also debarred for a period of 7 years from being appointed as auditor or internal auditor or undertaking any audit of financial statement or internal audit of functions or activities of any company or body corporate.

Thus, it gives a very good example to even the new CA’s who are coming into practice to check the conduct of the company and not provide a false audit report for a short term benefit or it can cost you an entire career.

To read full order CLICK HERE.