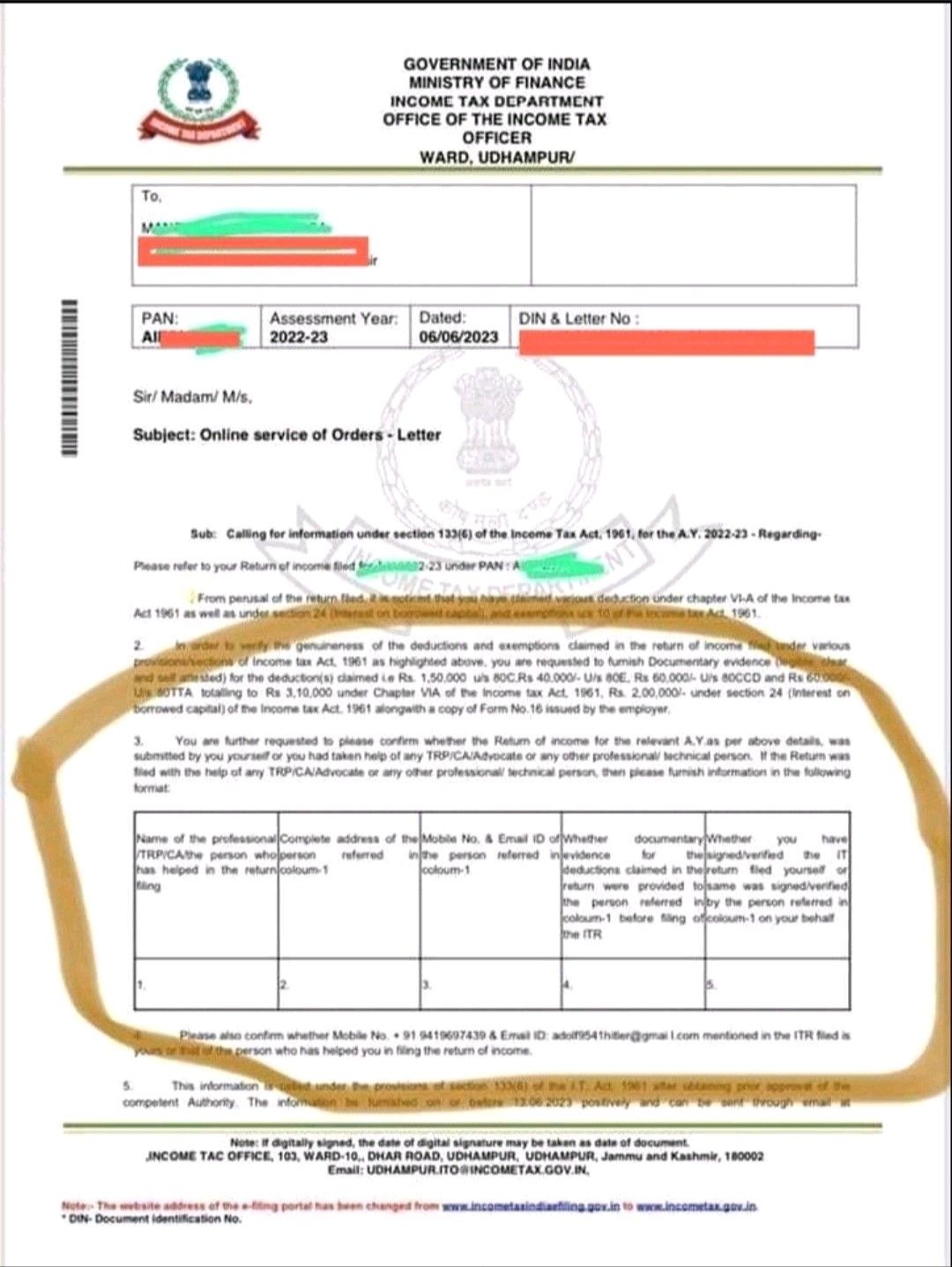

Recently all of us have seen a notice being circulated on social media wherein Income tax officer has issued a summons u/s 133(6) of the Income Tax Act to an assessee who is apparently an employee and asking for various data such as Form 16, proof of deductions claimed by assessee under various sections such as 80C, 80E, 80CCD, home loan interest etc.

Further, in the next para they have even asked as to whether the return was prepared by self or by some CA/ TRP (tax return preparer)/ Advocate and provide details of such person who prepared his return and also confirm if the return was signed by him or not.

In the table mentioned in the notice it has been also asked whether all documentary evidence as required to claim deduction under Income Tax Act were provided to the person who prepared Income tax return or not.

Relevant image of notice being circulated as under:

This comes as a very alarming situation for all the Chartered Accountant and tax practitioner who were just filing return of income based on the details provided by assessee and were asking for all documents of deductions or claim being made by assessee. Further, in the current income tax return the IP address of the filer of income tax return appears and hence one can find out from where such income tax return was filed.

However, the income tax return is signed and verified by all assessee themselves and various representations have also been made wherein it has been said that all the returns are being filed and signed by assessee and Chartered Accountants are just acting as a facilitator and hence they cannot be held liable for the Income tax return filed for assessee.

Considering, the above notice it is also recommended that tax filer, Chartered Accountants should always get a confirmation of clients before filing income tax return.

Also, a sample declaration has been prepared for all professionals which they could use and get it signed from the client before filing their return of income to secure themselves. This could be similar to a audit declaration which we take from management at the time of statutory audit.

To download the declaration CLICK ME.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

Connect with us on: LinkedIn, Telegram, Instagram, Facebook and Youtube for regular Updates.