Income tax issues order to remove old demand as was proposed in Interim Finance Bill, 2024

As discussed earlier, it was proposed by Hon’ble Finance Minister in her Interim budget speech for 2024 that it shall remove all small demand pending as per Income tax records till AY 2015-16.

To read more about this and other proposals in Interim Budget, 2024 CLICK HERE: Relief for the taxpayers with old demand related to A.Y. 2015-16 and before [Interim Finance Bill, 2024] – Taxontips

Now, Income Tax department has issued a notification and issued instructions to the department to remove such demand from online e-filing portal.

| Assessment year to which the demand entry relates as on 31st January 2024 | Monetary limit of entries of outstanding tax demand which are to be remitted or extinguished |

| Upto AY 2010-11 | Each demand entry upto Rs. 25,000/- |

| AY 2011-12 to AY 2015-16 | Each demand entry upto Rs. 10,000/- |

However, in the notification it has been mentioned that maximum total demand which will be removed from the portal shall be subject to maximum ceiling of Rs. 1,00,000/-. Thus, if your total demand for the years combined could not exceed Rs. 1 lakh.

Further, such demand shall not include demand related to TDS deduction and TCS collection i.e. deductor related demands visible on TRACES are not covered under this.

Further, once the demand is removed no interest shall also be required to be paid on same. Hence, it is also clarified that the limit prescribed above for each year would be only demand amount without interest.

Such removal of demand shall not allow assessee to claim any refund against the same.

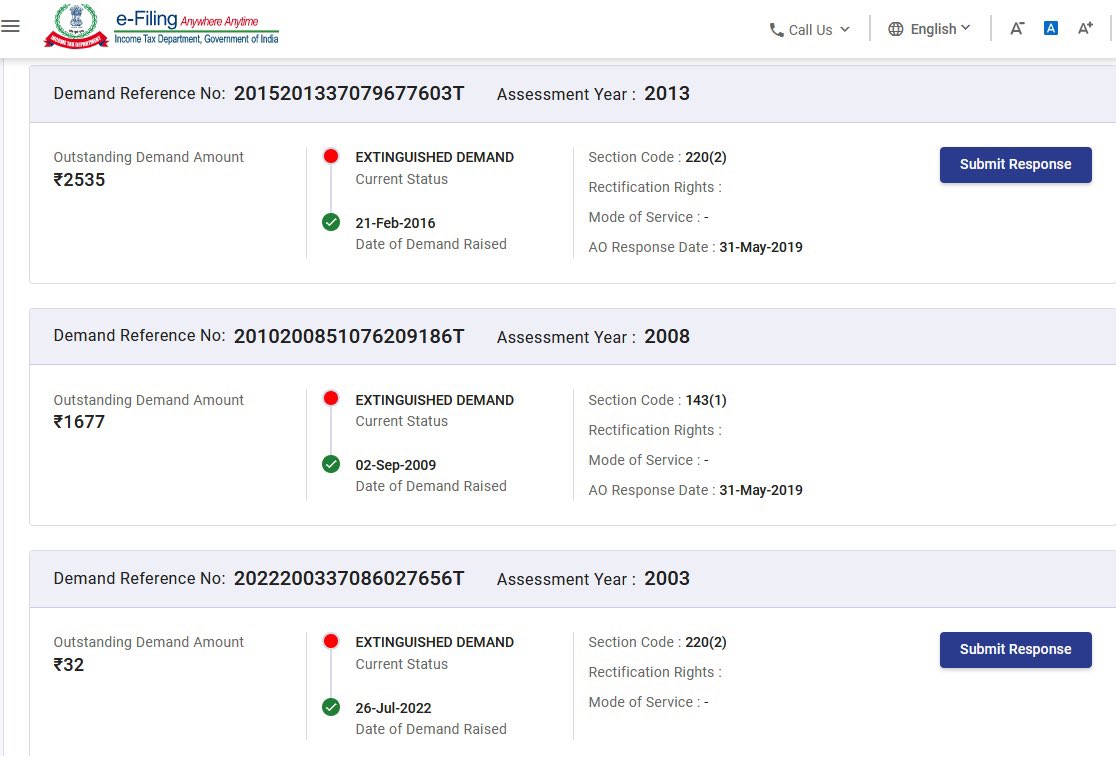

Further, even on portal the demand are getting extinguished on various assessee as can be seen from the image:

To read more about same CLICK ME.

Connect with us on: LinkedIn, Telegram, Instagram, Facebook, Twitter and Youtube for regular Updates.