On 11th November 2019 many of us tried to log in to e-filing website of Income tax department to submit our reply for e-assessment or some other work but we were either getting a message that “session expired” or “can’t reach this page” and we didn’t knew why is this happening or have we logged in to GST website because we such things happening many times on GST website.

But that was not the case the actual thing was that website was under maintenance but it was the wrong time to keep the website under maintenance as it’s December and due date for closing assessment proceedings is near hence it was last date for many people to submit their reply against show cause notices or other such notice and people couldn’t do it, hence it would have been better if such maintenance was done in midnight and people should have atleast mailed their reply to the respective assessing officer so that they could have fulfilled the due date of submission.

Now let’s take a look at the updates that have been made on e – filing website. As per my observation there were 2 major updates done on e – filing website and both were done to support the upcoming faceless scrutiny scheme of our government.

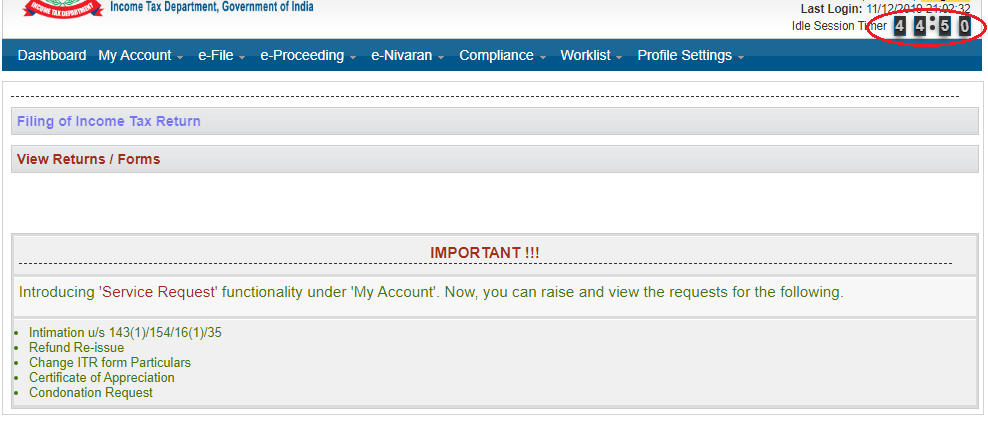

- Increase in Time limit to stay logged in:

The time limit for idle screen on e filing website has been increased from previous limit of 15 mins to 45 mins and this step is welcomed because previously people used to try to submit a reply on e assessment and either, a filed used to take more time to upload or we needed more time to type our reply and many a times this 15 mins time used to get exhausted and since e – proceedings section used to not have save draft feature we had to again type everything and attach all files again. Now with increase in this time we could easily attach our files and submit our reply in one go.

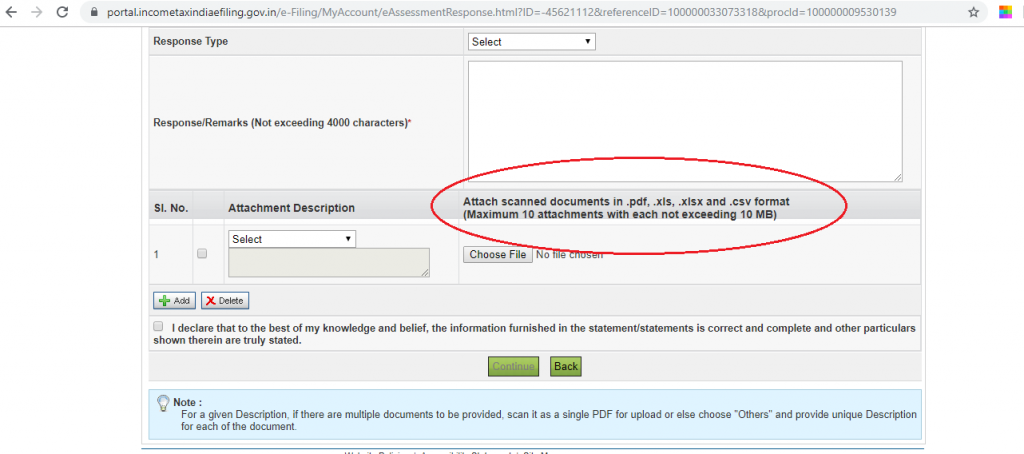

- Increase in size of attachment for e – proceedings:

The file size limit for attachments has been increased from 10 attachments of total 50 mb to 10 attachments of total 100 mb (i.e. each file cannot be more than 10 mb. Also the limit of words to write our reply has been increased to 4000 words. There was a requirement of increase in this limit because now we will have to submit all details online and if we don’t have such limit we won’t be able to scan all files and submit the same.

- Add Authorized representative:

They have also introduced a feature known as add authorized representative and it’s same as giving a power of authority to someone to represent before the income tax department. As you can see the assessee can add anyone over this portal and he/she can be a Chartered accountant, his relative, employee etc and thus requirement of submitting letter of authority won’t be there but I am still confused as to how this would be useful because they will still submit the reply using assessee’s log in, may be in future the department would create a separate log in for authorized representative from where they can submit reply for all people whom they are representing because right now all authorize representative are just using the log in of assessee to submit any of their reply.

Let’s hope this faceless scrutiny brings relief for assessee rather than increasing it.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.