Finance Act, 2021 had introduced tax on virtual digital asset, by virtue of section 115BBH, which includes cryptocurrencies, NFT etc. In the said section it was told that income from cryptocurrency shall be taxed at 30%, nothing other than cost of acquisition shall be reduced from receipts of virtual digital asset to calculate income and loss of virtual digital asset shall not be set off against any other income.

To read more on such taxation CLICK HERE: [Breaking News] India will now charge tax on Digital asset including cryptocurrency, NFT etc at 30%: Section 115BBH – Taxontips

In our post also we had mentioned that the finance bill had not defined what will be considered as cost of acquisition and whether loss of virtual digital asset will be set off against each other as many people were saying that even loss of one virtual digital asset won’t be allowed to set off against income of another virtual digital asset.

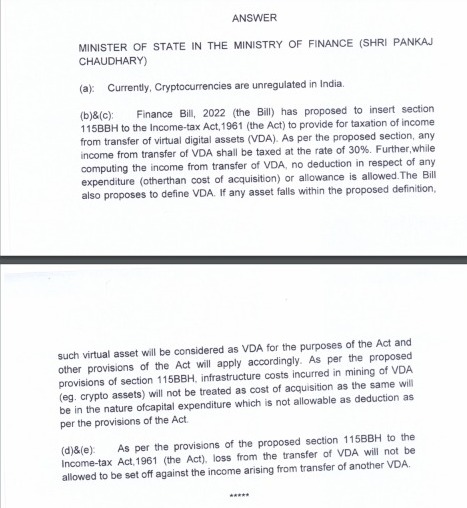

The same question has now been raised in Lok Sabha in a session where Finance Bill was getting discussed and the answers/ clarification offered for the queries by Ministry of State in the Ministry of Finance (Shri Pankaj Chaudhary) against the questions of Karti Chidambaram is as under:

1. Whether cost of mining cryptocurrencies be considered as cost of acquisition?

Ans: This question has been answered in point (b)&(c) of the attached extract wherein it has been mentioned that:

“As per the proposed provisions of section 115BBH, infrastructure cost incurred in mining of VDA (eg. crypto asset) will not be treated as cost of acquisition as the same will be in the nature of capital expenditure which is not allowable as deduction as per the provisions of the Act”

Thus, mining cost which is the only cost one would incur to generate and sell cryptocurrency won’t be allowed as expenditure and hence any person mining cryptocurrency in India will have to pay tax at 30% on entire sale consideration which shows that government is discouraging mining activities in India.

2. Whether loss from one virtual digital asset can be set off against income from another virtual digital asset?

Ans: This question has been answered in point (d)&(e) of the attached extract wherein it has been mentioned that:

“As per the provision of the proposed section 115BBH to the Income Tax Act, 1961 (the Act), loss from transfer of VDA will not be allowed to be set off against the income arising from transfer of another VDA.”

Although ministry has said that loss from one VDA will not be set off against another VDA however still there needs to be a clarification as to whether two cryptocurrency i.e. Ethereum and Bitcoin will be considered as separate virtual digital asset or cryptocurrency and NFT will be considered as separate Virtual digital asset.

Also, we need to still wait until the Finance bill is passed by both houses of Parliament and get’s assent of President as earlier also many changes were seen in the Finance Act and the erstwhile Finance Bill.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 1