LLP i.e. Limited Liability partnership is a combination of a company and partnership where it has the limited liability concept of a company and flexibility of a partnership firm.

LLP Act was incorporated in 2008 and it’s been more than a decade but even till now people are getting confused as to whether it is a company or a firm? So let’s try to discuss the same.

First let’s discuss the various FAQ issued by MCA (i.e. ministry of corporate affairs) on LLP which are as under:

LLP is an alternative corporate business form that gives the benefits of limited liability of a company and the flexibility of a partnership.

They have described structure of LLP as: “LLP shall be a body corporate and a legal entity separate from its partners. It will have perpetual succession.”

Hence, looking at the structure of LLP from MCA’s point of view we would think that LLP should be considered as a company.

Now, let’s have a look at how LLP has been described under the Income tax act:

As per section 2(23) of the Income Tax act, 1961 Firm has been defined as under:

“”firm” shall have the meaning assigned to it in the Indian Partnership Act, 1932 (9 of 1932), and shall include a limited liability partnership as defined in the Limited Liability Partnership Act, 2008 (6 of 2009)”

Thus, according to this definition LLP is a firm and in equivalent to a partnership firm in this respect. Further the tax rate of LLP is also similar to that of LLP i.e. Flat 30% tax plus cess.

Also, the profit received by a partner of an LLP is also exempt u/s 10(2A) in his own hands and is similar to the provisions or benefits available to a partnership firm.

Although till now LLP and firm are on equal footing, however there are few provisions where a LLP does not get the benefits like partnership firm:

Presumptive Taxation:

As we know section 44AD and 44ADA which deals with presumptive taxation under Income tax Act wherein the assessee is allowed to declare a certain percentage of turnover as profit which needs to be either equal to or more than the minimum profit prescribed if they do so they are not required to maintain books of accounts.

Now, under both these sections a partnership firm is allowed to take benefit and is considered as eligible assessee, however a LLP is not allowed to take benefit of presumptive taxation.

Also, LLP has to file ITR 5 which is also used by partnership firm. Further when you apply for a PAN card of a LLP your fourth letter in the PAN card is “F” which represents that it is firm under Income Tax Act.

Hence, in many aspect other than presumptive taxation, LLP is considered as partnership firm and not a company under the Income Tax act.

However, if we look at the registration process of Income tax act on e-filing website we feel that they are themselves a bit confused about LLP or want’s to confuse the taxpayer.

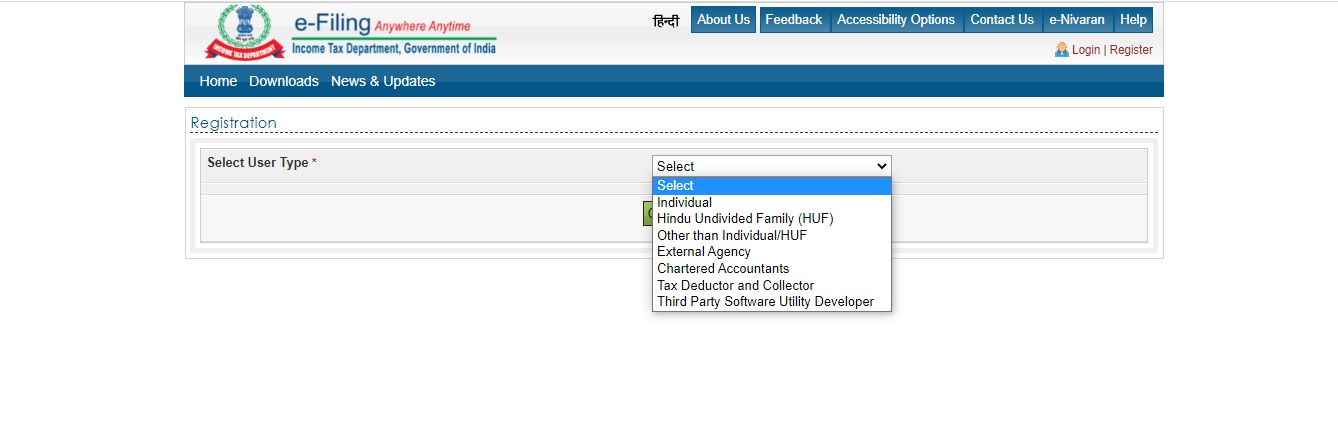

When you first start the registration process of any assessee on e-filing website you will see this page wherein you have to select user type and one has to choose other than Individual/HUF if they wish to register any firm or company or any other type of assessee

Once you select other than Individual/ HUF you will all the choices as mentioned below. Now if you choose Firm it will simply ask you PAN, Name and date of incorporation and take you further in the registration process.

Once you select other than Individual/ HUF you will all the choices as mentioned below. Now if you choose Firm it will simply ask you PAN, Name and date of incorporation and take you further in the registration process.

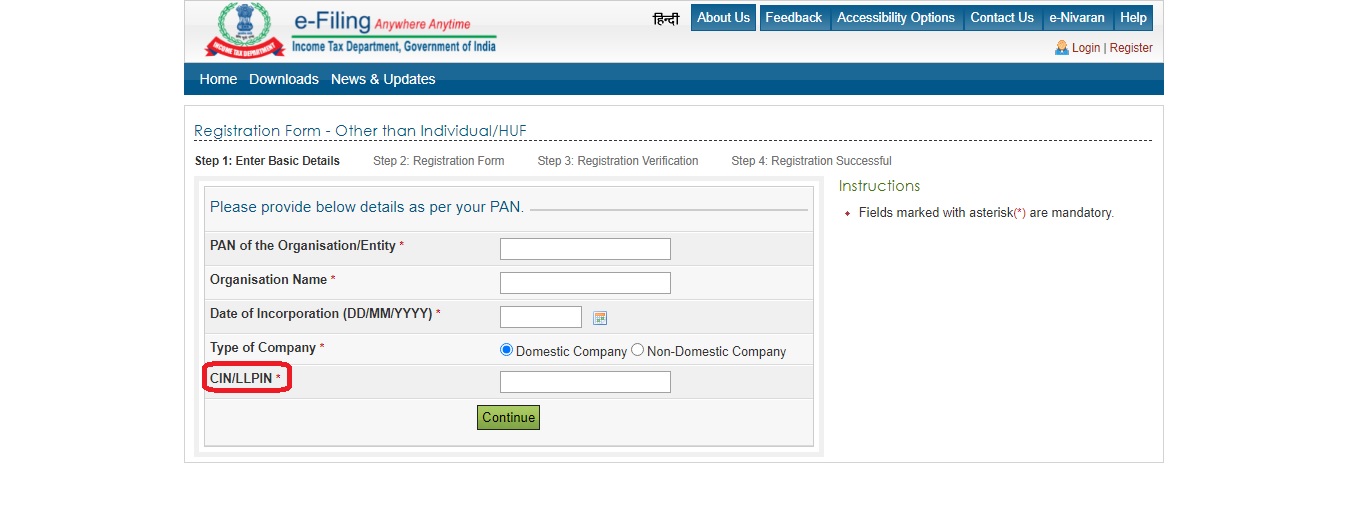

However if you choose Company and then select domestic company it will give you an option to submit LLPIN.

However if you choose Company and then select domestic company it will give you an option to submit LLPIN.

Now the question which will come to the mind of any layman after registering LLP on MCA is to register the LLP as company under Income tax act as well and when they see such option it will confuse them as to why on one hand it has been covered under definition of firm and on other hand covered under company.

Now the question which will come to the mind of any layman after registering LLP on MCA is to register the LLP as company under Income tax act as well and when they see such option it will confuse them as to why on one hand it has been covered under definition of firm and on other hand covered under company.

When we had asked the same question to e-filing website administrator via e-mail they replied us and just said that register it as a firm. So rather than taking this as a feedback and removing the option of LLPIN under company head they just replied to register as a firm. The e-mail is as under:

“Dear sir/ ma’am, This is with regard to the issue/ dilemma we are facing while registering LLP on e-filing website. As per Income tax we have applied for LLP PAN and the fourth letter of PAN is “F” which means it is registered under the category of Firm and hence it should be registered as firm under income tax e filing website. However under the category of company when we select domestic company we can submit LLPIN. If LLP is a firm for income tax purpose why are we getting an option to submit LLPIN under company category? Please don’t give me the answer that I should register it as a firm, this is a feedback for the website to either explain me the purpose of mentioning LLPIN there or remove it as it confusing many people. Screenshot of same is enclosed for your reference. Hope to get a quick response as this should not be a big issue. P.S. The call centre people are not well trained to answer this question and were not even transferring call to superior when asked to, would humbly request to have such an option where call can be transferred if they are unable to answer.

Resolution Inputs:

Kindly select sub-user type as Firm to proceed further.”

So as you can see from the extracts of above e-mail they did not take the feedback in a right manner. However, you have to register the LLP as a firm which is correct as per Income tax act and don’t have to confuse yourself with the incorrect option provided by e-filing website.

Let’s hope this issue is resolved when e-filing team launches the new website on 07.06.2021

What is your rationale behind e-filing website providing such an option? Comment below.