1. Overview

The My Bank Account service is available to all registered taxpayers on the e-Filing portal (post-login), who have a valid PAN and a valid bank account. This service allows you to:

- Add a bank account and pre-validate it

- Remove a closed or deactivated bank account

- Nominate a validated bank account to receive Income Tax refund

- Remove a bank account from nomination so as not to receive tax refund in that account

- Enable or disable EVC for the validated bank account (only for individual taxpayers)

- Revalidate bank accounts for which pre-validation has failed

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

- PAN must be linked with the bank account which is to be pre-validated

- Active bank account:

- linked with PAN

- linked with registered mobile number (mandatory) and email ID (optional)

- Valid mobile number:

- registered with e-Filing

- linked with active bank account

3. Step-by-Step Guide

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: Go to the My Profile page from the Dashboard.

Step 3: Click My Bank Account available on the left side of screen.

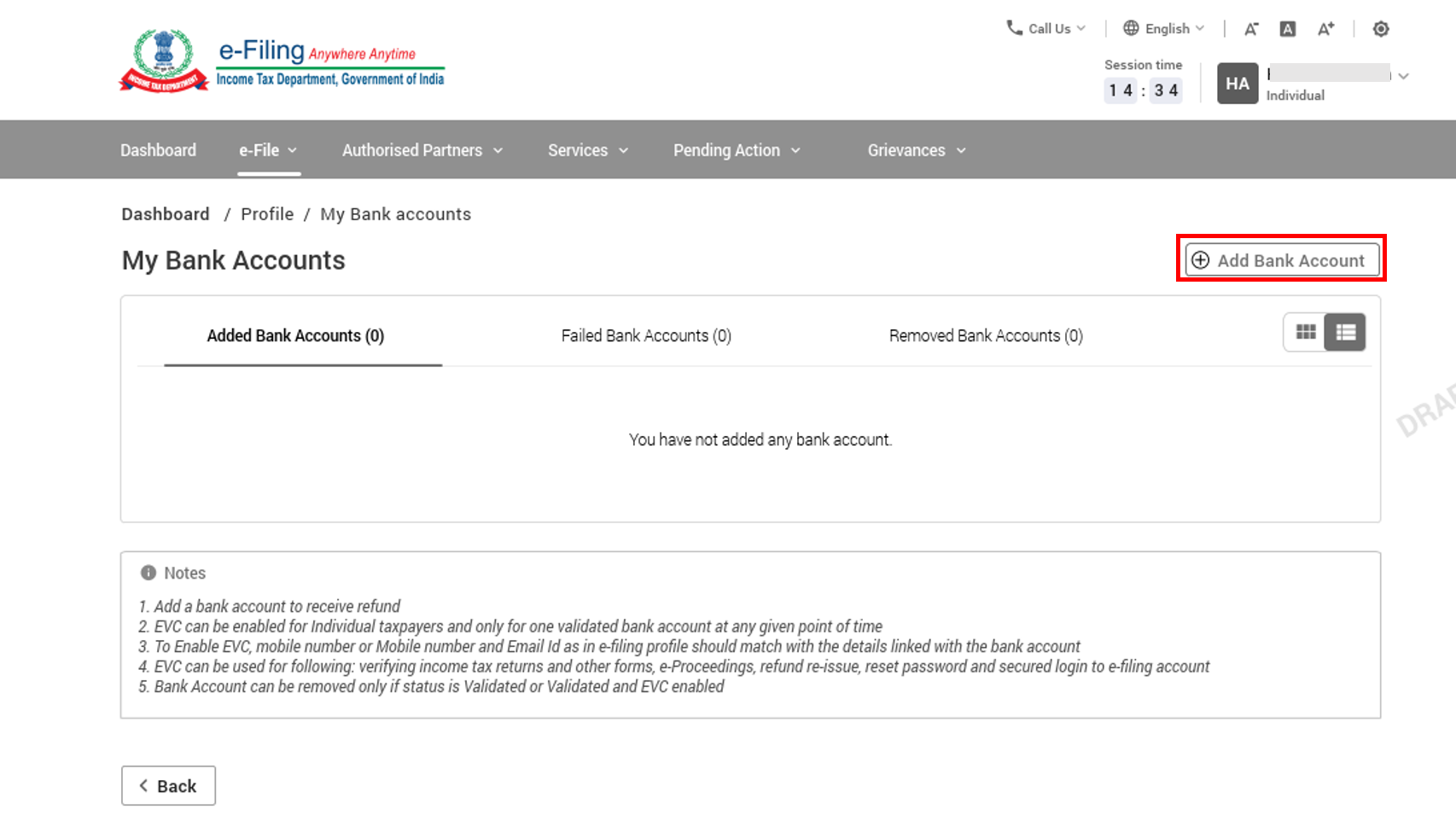

On the My Bank Accounts page, the Added, Failed and Removed Bank Accounts tabs will be displayed.

Now, let’s see how you can Add and Pre-validate the bank account:

Add and Pre-Validate a Bank Account

A. By logging in to the e-Filing portal using PAN / Aadhaar

Step 1: On the My Bank Accounts page, click Add Bank Account.

Step 2: On the Add Bank Account page, enter the Bank Account Number, Account Type and Holder Type, and IFSC. Bank Name and Branch get auto-populated based on IFSC. Your mobile number and email ID will be pre-filled from your e-Filing profile, and will not be editable.

Step 3: Click Validate.

On successful validation, a success message is displayed. You will also receive a message on your mobile number and email ID registered on the e-Filing portal.

B. By logging in to the e-Filing portal using Net Banking

Step 1: Log in to the e-Filing portal using your Net Banking account.

Step 2: On login through Net Banking, the e-Filing portal will verify if the bank account used for login exists under the Added Bank Accounts tab. If the bank account is not already added, a confirmation message with the masked account number and IFSC is displayed, asking you to confirm if you want to add the account to e-Filing portal. Click Continue.

On confirmation (for both methods A and B), the bank account details are included under the Added Bank Accounts tab with the status as follows:

- Validated (if EVC is enabled for any existing bank account) OR

- Validated and EVC enabled (if PAN, Account Number, IFSC, and mobile number are successfully validated by the bank, and if EVC is not enabled for any other bank account).

Adding a bank account will help you in many ways such as: Getting refund from Income tax, E-verify income tax return or any other forms etc.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)