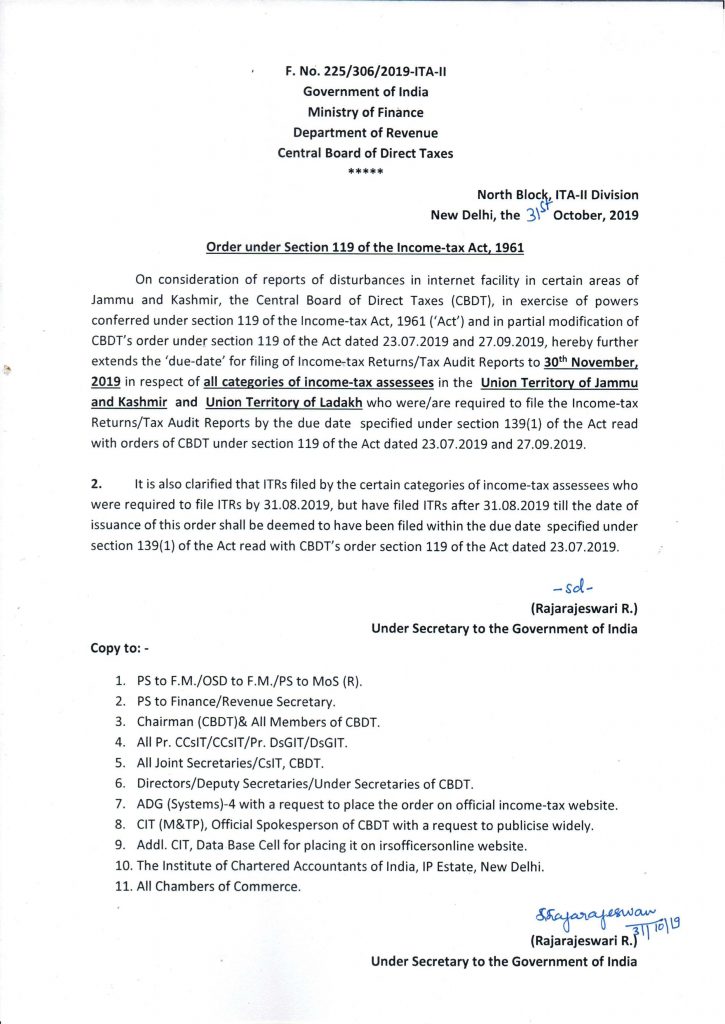

CBDT vide order u/s 119 Dt. 31st October 2019 extended the due date for filing Tax audit report and Income tax return for tax payers in the Union territory of Jammu and Kashmir and Union territory of Ladakh from 31st October to 30th November.

It further mentions that people who were required to file their return by 31.08.2019 i.e. people who were not required to get their accounts audited have filed their return after 31.08.2019 but before the issuance of this order i.e. before 31.10.2019 it would be considered as if they have filed the return within due date.

Now in the second point it no where mentioned that it relates to only the people of Jammu & kashmir and Ladakh so it might apply to every citizen of India but till the time we receive further clarification we should assume that this will be applicable only for the people in the above Union territories. What this will do is bring you back the refund of late fees paid by you for filing return after 31.08.2019.

Also in this notification they haven’t clearly mentioned that increase in the date won’t be applicable for section 234A but since they have mentioned that extension in due date is just amendment to the date mentioned in previous notice it is clear that interest u/s 234A will still be applicable.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

You can download the notification at : Extension of Tax audit due date