In our many past articles we had talked about various glitches which people are facing in filing their Income tax return which includes not able to e-verify Income tax return or issues such as interest u/s 234A being charged where ITR is not available on Income tax e-filing website.

Due date for filing of Income tax return were extended to 30.09.2021 for the assessee’s who were liable to file Income tax return on 31.07.2021 by way of circular on 20.05.2021.

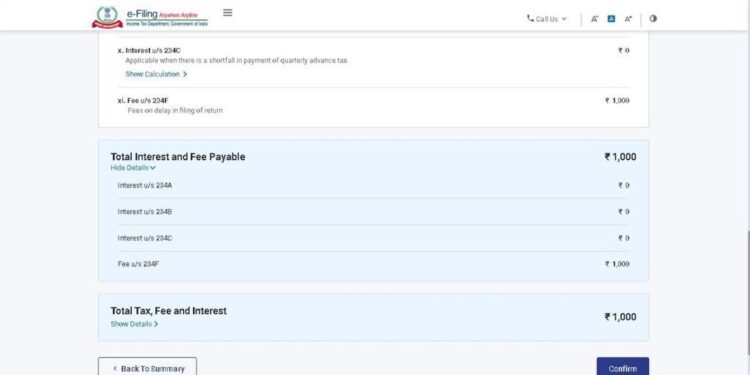

However, it seems that same has not been incorporated on the e-filing portal till date as the people are still facing the issues when they are filing Income tax return after 31.07.2021 wherein they are being asked pay late fees u/s 234F of the Income tax Act even when the due date has been extended to 30.09.2021 from 31.07.2021 and one cannot edit the late fees or remove the same.

Hence, it is suggested to wait for a few days and then file your Income tax return if you are also facing this late fees.

However, you can still submit your details to our expert and book your slot to understand tax liability and prepare your Income tax return by clicking at the below link.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for Income tax CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST CLICK ME.

To book general phone consultation with expert CLICK ME.