Return filing due date is round the corner and majority of the assessee have filed the return and some of the return have also been processed.

While filing the return of income if you have received any income which is supposed to be in the nature of business such as commission wherein TDS is deducted u/s 194H or professional fees wherein TDS is deducted u/s 194J and you have shown such income under Income from other sources considering that this is not the main income of assessee and accordingly same could be disclosed under income from other sources.

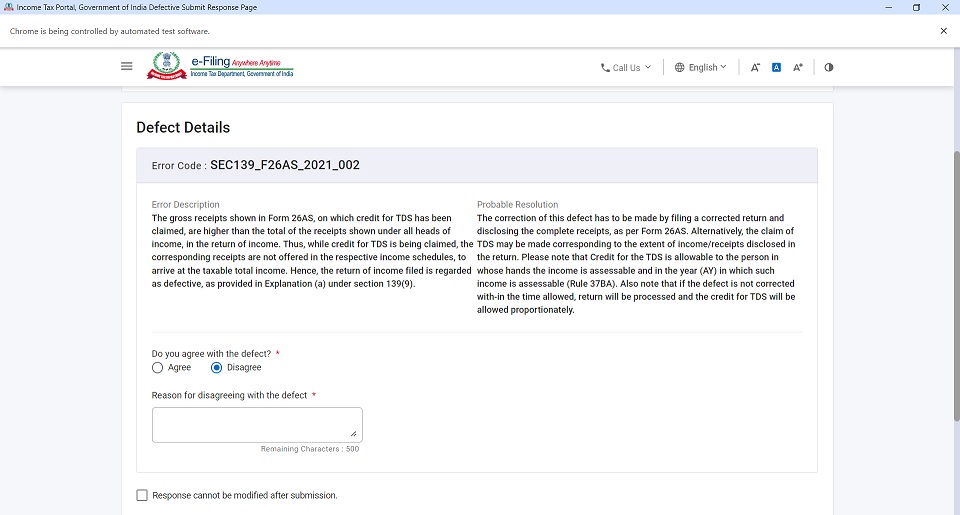

However, while processing the return the Income tax department is showing such return as defective return under section 139(9) of the Act, stating that the corresponding gross income has not been offered to tax hence the return is considered as defective.

Relevant extract of Section 139(9) is as under:

“(9) Where the Assessing Officer considers that the return of income furnished by the assessee is defective, he may intimate the defect to the assessee and give him an opportunity to rectify the defect within a period of fifteen days from the date of such intimation or within such further period which, on an application made in this behalf, the Assessing Officer may, in his discretion, allow; and if the defect is not rectified within the said period of fifteen days or, as the case may be, the further period so allowed, then, notwithstanding anything contained in any other provision of this Act, the return shall be treated as an invalid return and the provisions of this Act shall apply as if the assessee had failed to furnish the return :

Provided that where the assessee rectifies the defect after the expiry of the said period of fifteen days or the further period allowed, but before the assessment is made, the Assessing Officer may condone the delay and treat the return as a valid return.“

Whereas, if we check the full ITR we can see that the income has been offered to tax and the corresponding TDS head has also been correctly chosen. They are giving only 15 days time to respond to such defective notice issued u/s 139(9) of the Income tax act and if one fails to respond to such notice it will be considered as if the return was never filed.

Further, if the assessee looks at the notice after 31st and tries to file new return then it might be considered as belated return filed u/s 139(4) of the Income tax act and he might not be allowed to:

- Choose old regime of tax.

- Carry forward losses incurred if any.

Hence, this seems to be an issue created by Income tax department while processing the Income tax return wherein the return is considered as defective even when assessee has offered full income to tax and choosing a head of income is a choice of assessee and section of TDS cannot decide under which head assessee is required to offer such income to tax. Thus, we hope the Income tax department resolves this and many other issues before the 31st of July and provides assessee with a relief as the notice issued u/s 139(9) of the act is also a non-appealable order/ notice.

Guidance on above article on Income Tax by:

Naman Maloo (C.A., B.Com)

He is currently working as Partner – Direct Tax with a renowned firm in Jaipur having experience in dealing Assessments before Income Tax authority, Tax Audit, International Taxation, Tax planning for NRI, Business planning and consultation.

E-mail: naman.maloo@jainshrimal.in | LinkedIn: Naman Maloo

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)