Cost inflation index (CII) is used in Income Tax to give inflation effect to cost for long term capital asset purchased before 1 or 2 or 3 years in different situations and depending on the type of capital asset and as we know with time and inflation value of goods increases, and thus to save people from getting taxed because of increase in value of goods as an effect of inflation, CBDT allows people to adjust cost inflation index to original cost and to include inflation effect while calculating Long term capital gain.

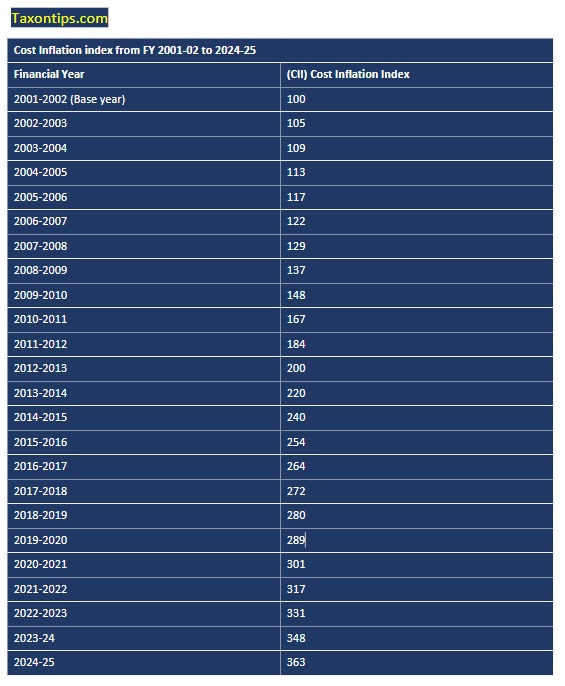

Cost inflation index has been announced for F.Y. 2024-25 at 363 and for previous FY 2023-24 it was 348.

Indexed cost of acquisition has been explained in section 48 as “an amount which bears to the cost of acquisition the same proportion as Cost Inflation Index for the year in which the asset is transferred bears to the Cost Inflation Index for the first year in which the asset was held by the assessee or for the year beginning on the 1st day of April, 2001, whichever is later”

Also proviso to section 48 i.e. Mode of computation of capital gain states the mode when such cost inflation index needs to be used and when it will not be used as “that where long-term capital gain arises from the transfer of a long-term capital asset, other than capital gain arising to a non-resident from the transfer of shares in, or debentures of, an Indian company referred to in the first proviso, the provisions of clause (ii) shall have effect as if for the words “cost of acquisition” and “cost of any improvement”, the words “indexed cost of acquisition” and “indexed cost of any improvement” had respectively been substituted:

Provided also that nothing contained in the first and second provisos shall apply to the capital gains arising from the transfer of a long-term capital asset being an equity share in a company or a unit of an equity oriented fund or a unit of a business trust referred to in section 112A”

From the above it is clear that whenever you earn long term capital gain you’ll convert your cost of acquisition into indexed cost of acquisition using the cost inflation index provided below. However there are certain situations where even if you have gain from long term capital asset you won’t be able to get benefit of indexation:

- When an NRI earns any capital gain from the transfer of shares or debentures of an Indian company i.e. if he earns capital gain from sale of land he can use cost inflation index.

- Cost inflation index won’t be available to anyone when the capital gain is taxable under section 112A i.e. it is applicable on long term capital gain from sale of equity share in a listed company on which STT paid or equity oriented fund or unit of a business trust.

- Cost inflation index will not be applicable on long-term capital gain arising from the transfer of a long-term capital asset, being a bond or debenture other than— (a) capital indexed bonds issued by the Government; or (b) Sovereign Gold Bond issued by the Reserve Bank of India under the Sovereign Gold Bond Scheme, 2015:

- Capital gain on debt mutual fund and market linked debentures. To read more CLICK ME.

Other than the above situation whenever you earn long term capital gain you can use indexed cost of acquisition to calculate your capital gain.

Now let’s see how you can use this cost inflation index:

For eg: You had purchased a land on 01.02.2005 for Rs. 15 lakh and you are going to sell it on 01.06.2024. So, the indexed cost of acquisition for the land would be Rs. 48.19 lakh (i.e. 15*363/113). Thus, you need to reduce this cost from your sale price.

To read the notification No. 44/2024 Dt. 24.05.2024 CLICK HERE

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.