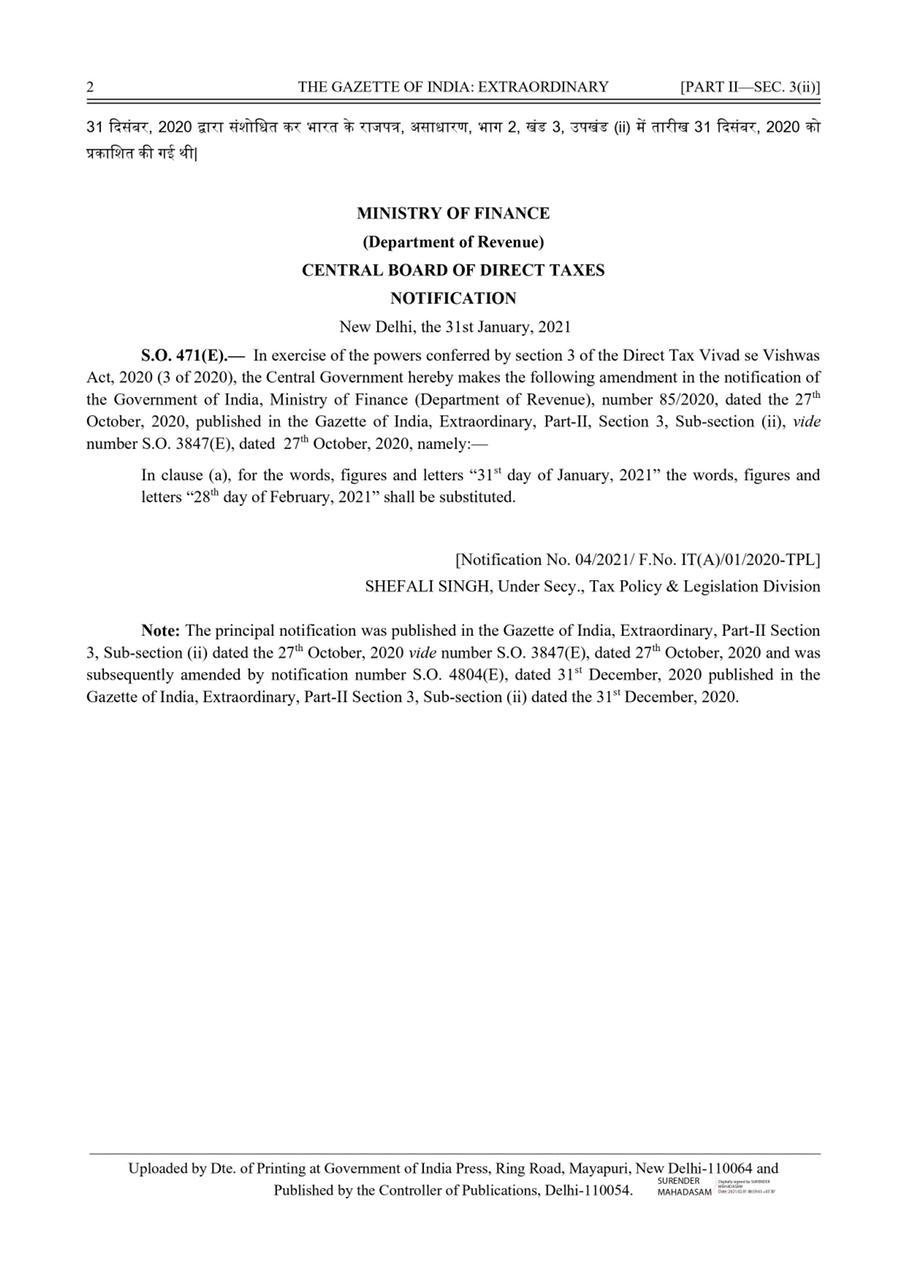

CBDT further extends the date for filing of declarations under the #VivadSeVishwas Act, 2020 to 28th February, 2021.

Notification in S.O. 471(E) dated 31/01/2021 has been issued. Date for payment of tax without additional interest under VSV remains unchanged at 31st March, 2021.

Earlier the due date for filing application for VSV scheme was 31.01.2021.

It is worthwhile to note that the due date for pending appeal is still 31.01.2020 and same is unchanged.

₹ 95,000-Crore Disputed Amount Settled Under Vivad Se Vishwas: PC Mody. In the Budget Speech also our hon’ble Finance minister had mentioned that the VSV scheme has been used by many taxpayers to resolve their ongoing disputes.

Are you still confused that whether you should go for VSV scheme or don’t know how to file the form for same, book a consultation with our experts and get your query solved.

CLICK HERE to book consultation.