Income tax department provides an option to Chartered Accountants to register on e-filing website with their membership number and then file/ submit various forms/ report such as Form 15CB, Tax audit report to Income tax department which is required as per the Income tax laws.

Such forms and reports are uploaded on the portal by the professionals using their special login id and password which is different form their user id and password which they use to file their personal Income tax return.

The “user ID” for such professional is not PAN card but combination of “ARCA” and “ICAI membership number of that professional”.

As we know e-filing 2.0 i.e. new e-filing website has been launched by Income tax department and old website is now of no use and hence all the filings needs to be done on the new website.

However, there are various issues still in the new e-filing website as we have already discussed, as before people were even facing issues while logging in to the website but then that issue was resolved and now people could login to their profile.

Now let’s talk about another issue which has come up with e-filing website 2.0 where the tax professionals are not able to file any Form for their clients as they are not getting any option for the same.

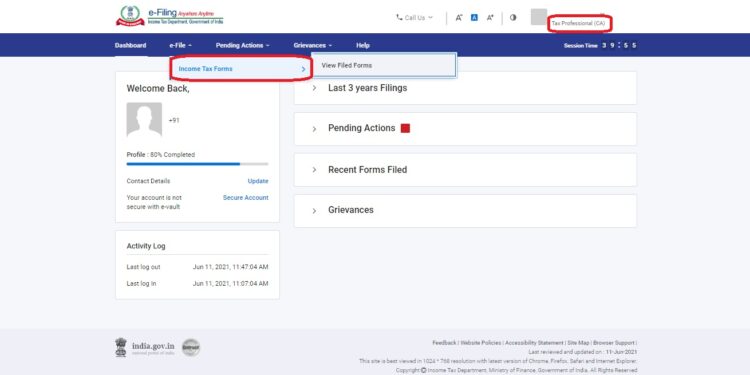

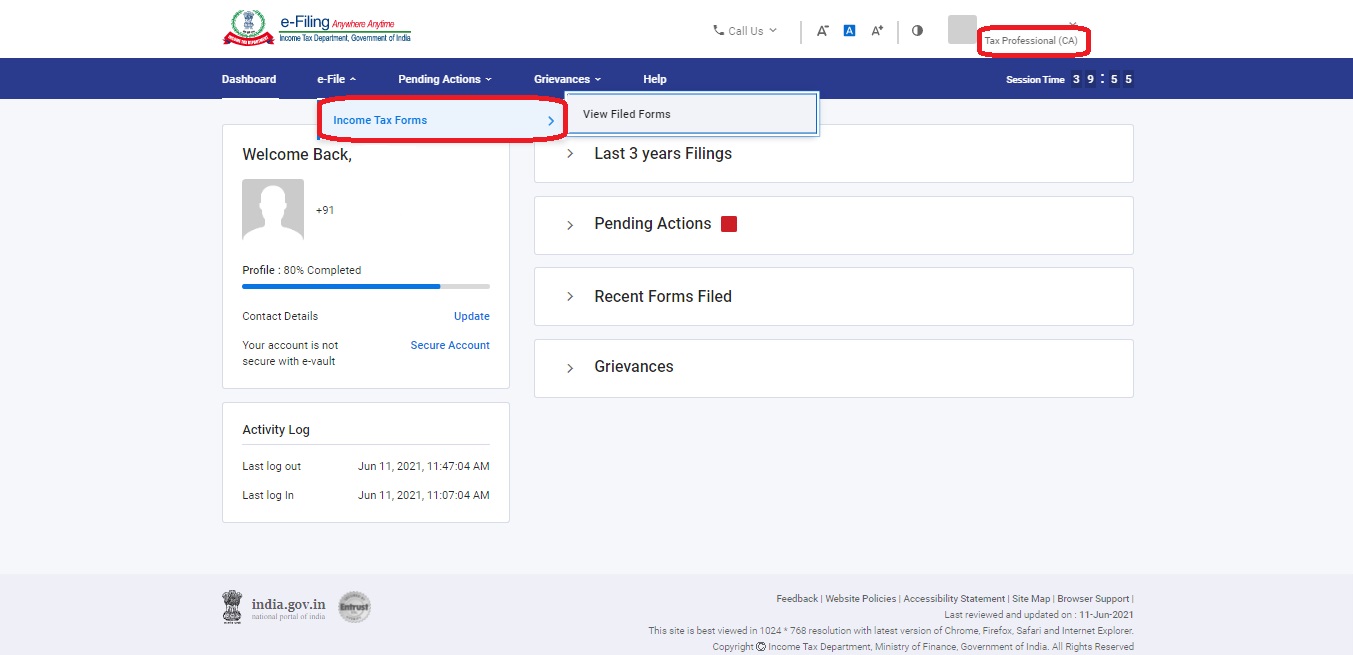

If we look at the image below we can see that under e-file -> Income tax Forms -> File Income tax forms option can be seen in case of normal individual but when we look at the same option for the professional we don’t find any such option. Relevant image is as under:

Now because of this partial availability of features from e-filing website professionals are having a tough time from their clients especially in relation to filing of Form 15CB which is related to foreign remittance of tax.

Now, normal assessee can file Form 15CA as he is getting the option but the professional is not getting the same option from portal and because of which there are various payments of assessee which is getting delayed and their suppliers are charging them interest, as bank won’t release foreign payment without Form 15CB.

Also, where Part C of Form 15CA is required to be filed same cannot be done without filing of Form 15CB and assessee is not able to understand that both login’s are different and why such option is not available with CA when the same option is available with him and because of such issue many CA’s are continuously getting calls to know if the portal is now working or not as they assessee needs to remit the payment and save his interest on the same.

So what are your opinion on same? Was it right on the part of Income tax department to shift the entire website at once when the old one was working correctly or it would have been better if they would have shifted it in phased manner or kept both website active for sometime and then stopped the old website.

Disclaimer: The views presented in the above article are personal views of our team and has no legal binding. For any legal opinion consult a tax professional.

To book phone consultation with experts CLICK ME.

To book ITR filing with experts CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

Comments 1