CA cannot certify Income tax return (ITR) even for loan purpose:

Recently in an FAQ issued by the ICAI it was asked whether a CA can certify the ITR of an assessee and whether he needs to issue UDIN for that certification against the same and in reply to such question the answer provided was, no a CA cannot certify it as true copy. We shall discuss this thing in detail but first let’s understand what’s UDIN.

UDIN is a latest service rolled out by ICAI which stands for “unique document identification number”. This service was launched by ICAI to stop false certification done in the name of Chartered Accountant as bank rely on such documents which have been issued by professional for loan and other purpose.

Therefore, after this service was rolled out any document certified by a CA needs to carry a UDIN. Hence any document certified by a Chartered Accountant won’t be considered as certified/true copy unless it has a UDIN. Therefore there was a question raised before ICAI that whether a CA can certify the ITR of individual which is generally required by banks for loan purposes?

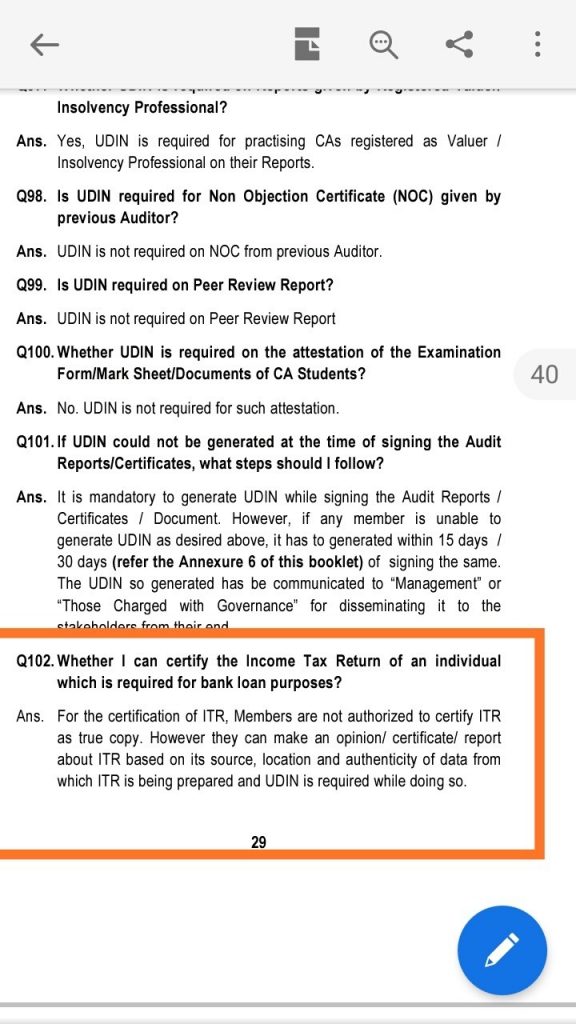

The question was raised in an FAQ at question number 102 can be read as under:

“Q 102. Whether I can certify the Income Tax return of an individual which is required for bank loan purpose?

Answer: For the certification of ITR, members are not authorized to certify ITR as true copy. However they can make an opinion/ certificate/ report about ITR based on it’s source location and authenticity of data from which ITR is being prepared and UDIN is required while doing so.”

Thus from the above point it is clear that members cannot certify ITR and which has created a huge question in the mind of professional’s as they used to certify ITR regularly for bank loan purpose of their regular clients and now they can’t do that and they won’t be able to explain it to their client. However I guess the answer provided by ICAI is correct as we can certify the audit report because we can check the figures mentioned in the financials and it’s our responsibility to make audit report and financials whereas filing Income tax return is the primary responsibility of assessee and in case of non audit assessee we cannot verify the figure mentioned in ITR unless proper records maintained. Hence we can only issue a certificate mentioning the source of the figures mentioned in ITR or whether the same has been properly upload on e filing website and certify the books of accounts but we cannot certify the ITR alone without any base.

The solution to above problem would be that bank stops asking for certified copy of ITR and rather ask for ITR or find some other way to provide loan just on the basis of ITR.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.