CBDT has recently rolled out a full fledged Annual Information Statement (AIS) which was announced to be released in June 2020.

However, in June 2020 CBDT renamed Form 26AS to Annual Information statement and added a few features of annual information statement but that was not a full fledged Annual Information statement.

Now, recently on 01.11.2021, CBDT has announced roll out of Annual Information statement by way of a Press release which read as under:

“Income Tax Department has rolled out the new Annual Information Statement (AIS) on the Compliance Portal which provides a comprehensive view of information to a taxpayer with a facility to capture online feedback. The new AIS can be accessed by clicking on the link “Annual Information Statement (AIS)” under the “Services” tab on the new Income tax e-filing portal (https://www.incometax.gov.in) The display of Form 26AS on TRACES portal will also continue in parallel till the new AIS is validated and completely operational.

The new AIS includes additional information relating to interest, dividend, securities transactions, mutual fund transactions, foreign remittance information etc. The reported information has been processed to remove duplicate information. Taxpayer will be able to download AIS information in PDF, JSON, CSV formats.

If the taxpayer feels that the information is incorrect, relates to other person/year, duplicate etc., a facility has been provided to submit online feedback. Feedback can also be furnished by submitting multiple information in bulk. An AIS Utility has also been provided for taxpayers to view AIS and upload feedback in offline manner. The reported value and value after feedback will be shown separately in the AIS. In case the information is modified/denied, the information source may be contacted for confirmation.

A simplified Taxpayer Information Summary (TIS) has also been generated for each taxpayer which shows aggregated value for the taxpayer for ease of filing return. TIS shows the processed value (i.e. the value generated after deduplication of information based on pre-defined rules) and derived value (i.e. the value derived after considering the taxpayer feedback and processed value). If the taxpayer submits feedback on AIS, the derived information in TIS will be automatically updated in real time. The derived information in TIS will be used for pre-filling of Return (pre-filling will be enabled in a phased manner).

Taxpayers should remember that Annual Information Statement (AIS) includes information presently available with the Income Tax Department. There may be other transactions relating to the taxpayer which are not presently displayed in Annual Information Statement (AIS). Taxpayers should check all related information and report complete and accurate information in the Income Tax Return.

The taxpayers are requested to view the information shown in Annual Information Statement (AIS) and provide feedback if the information needs modification. The value shown in Taxpayer Information Summary (TIS) may be considered while filing the ITR. In case the ITR has already been filed and some information has not been included in the ITR, the return may be revised to reflect the correct information.

In case there is a variation between the TDS/TCS information or the details of tax paid as displayed in Form26AS on TRACES portal and the TDS/TCS information or the information relating to tax payment as displayed in AIS on Compliance Portal, the taxpayer may rely on the information displayed on TRACES portal for the purpose of filing of ITR and for other tax compliance purposes.

Taxpayers may refer to the AIS documents (AIS Handbook, Presentation, User Guide and FAQs) provided in “Resources” section or connect with the helpdesk for any queries through “Help”section on the AIS Homepage.”

Briefs steps to download or view Annual information statement is as under:

-

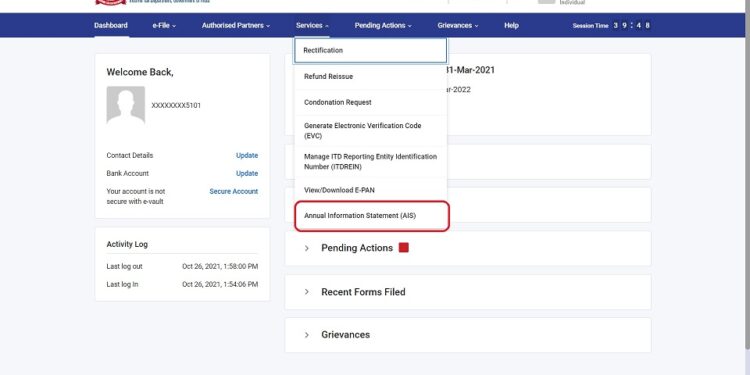

Login to your e-filing profile and after login under the Services tab you will find an option for Annual Information Statement as demonstrated in the image below:

-

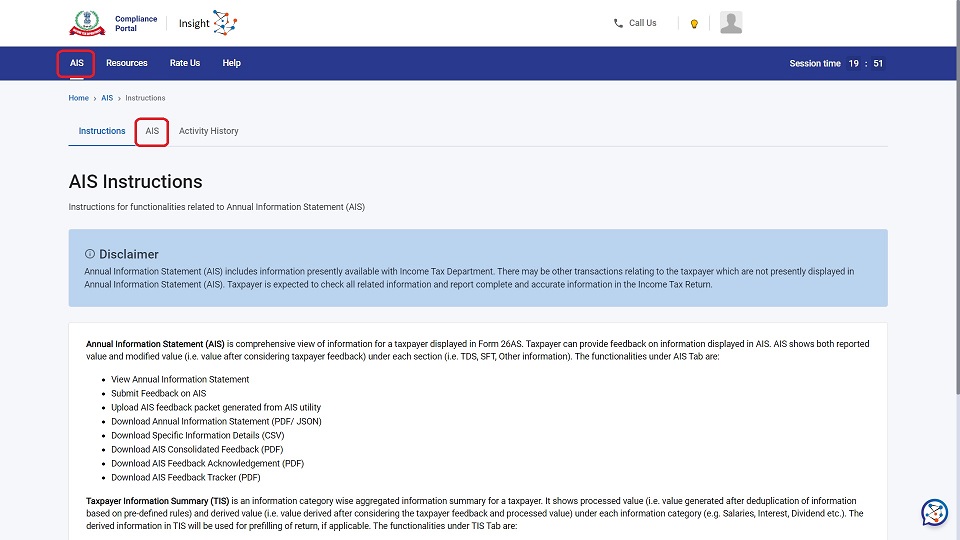

When you click on Annual Information Statement you will be redirected to Compliance portal, wherein you need to click on AIS and there you will be able to see your Annual Information Statement.

When you click on Annual Information Statement you will be redirected to Compliance portal, wherein you need to click on AIS and there you will be able to see your Annual Information Statement. -

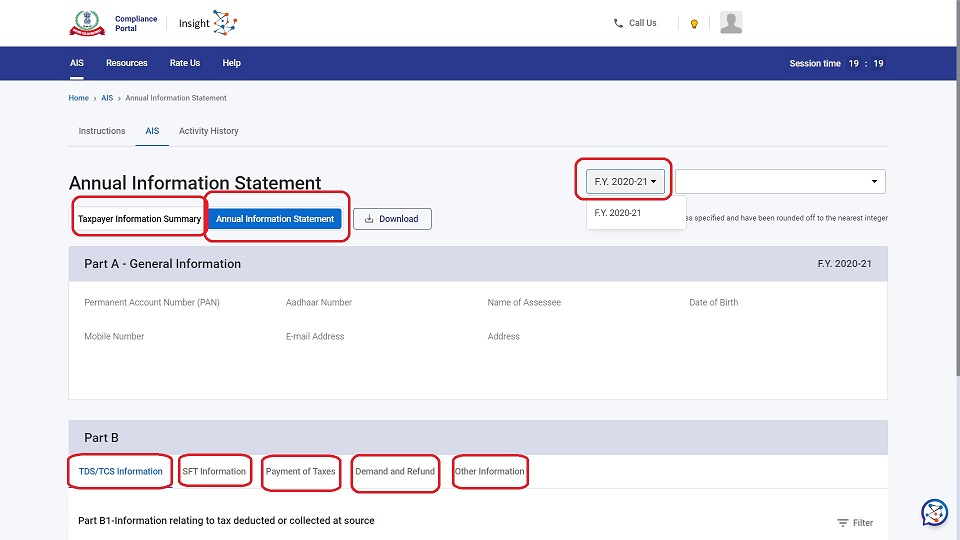

After you click on Annual Information Statement you will have two options available i.e. 1. either to look at full Annual Information statement or 2. look at the summary of Annual information statement i.e. Taxpayer Information Summary (TIS) which is an information category wise aggregated information summary for a taxpayer. It shows processed value (i.e. value generated after deduplication of information based on pre-defined rules) and derived value (i.e. value derived after considering the taxpayer feedback and processed value) under each information category (e.g. Salaries, Interest, Dividend etc.).

After you click on Annual Information Statement you will have two options available i.e. 1. either to look at full Annual Information statement or 2. look at the summary of Annual information statement i.e. Taxpayer Information Summary (TIS) which is an information category wise aggregated information summary for a taxpayer. It shows processed value (i.e. value generated after deduplication of information based on pre-defined rules) and derived value (i.e. value derived after considering the taxpayer feedback and processed value) under each information category (e.g. Salaries, Interest, Dividend etc.).

-

In the Annual Information Statement you can see various information such as: TDS/ TCS details, SFT details, Payment of Taxes, Demand & Refund and other Information. The tabs are more or less the same as Form 26AS but the amount of information has increased.

-

As of now Annual Information statement is available only for FY 2020-21 as can be seen in image above.

When you will log-in to Annual Information statement for the first time you will receive the below mentioned message from Income tax portal:

“Dear __________________, Thank you for accessing your Annual Information Statement. If you have not accessed AIS, go to Income Tax E-filing website (www.incometax.gov.in) and change password – Insight Support”

The Annual Information statement shall capture the below mentioned information as of now:

- a) Sale of Purchase of Equity shares

- b) Insurance

- c) Payment of Credit Cards bills

- d) Purchase of property

- e) Purchase or sale of Mutual Funds

- f) Details of Dividend earned

- h) Interest on Saving bank A/c and Deposits.

Further, one important feature which will be available in this Annual Information statement and which was missing in Earlier Form 26AS is to reject any information which is present in Form 26AS either in relation to TDS or SFT Transaction. We shall discuss about same in details in later post but the feature will be available in Annual Information statement.

One Major FAQ as of now after roll out of Annual Information statement is: Will 26AS be stopped?

a) No, you can access both 26AS and also AIS.

b) Both put together, Income Tax department knows all your financial transactions.

c) And it’s good as now you will find it very easy to know and submit details for your Income Tax returns.

CBDT has mentioned that until all functionalities of AIS are working properly they shall continue to keep Form 26AS, which they must have learnt after assessee faced issue in relation to new Income tax portal. Also, it has been mentioned by CBDT that in case of any discrepancy between AIS and Form 26AS, assessee can rely on Form 26AS for filing his return of income.

Annual Information statement shall play an important role now, as in future all the assessment’s under section 148 are going to be based on information and now assessee can also know what information is available with government and he/ she can file Income tax return accordingly.

Note: As this are the initial days of Annual Information statement you might face some issues in accessing it.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

Comments 2