In India GST was introduced in July, 2017 and there are various turnover and other conditions which needs to be fulfilled to get a GST registration. To get assistance with GST registration CLICK HERE.

Whenever a person applied for registration with GST department and gets GST registration certificate he still needs to do various things or else the registration might get cancelled.

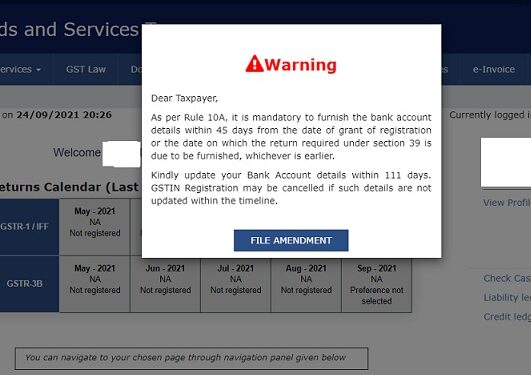

One such requirement for keeping GST registration is to submit bank details under Rule 10A of CGST rules, within 45 days of getting GST registration. The bank details which needs to be submitted are as under:

(1) IFSC code of bank

(2) Type of Bank account

(3) Bank account number and

(4) PDF or JPG of any one of the documents: Bank statement, cancelled cheque or passbook copy.

Relevant extract of Rule 10A is as under:

“10A.Furnishing of Bank Account Details.-After a certificate of registration in FORMGST REG-06 has been made available on the common portal and a Goods and Services Tax Identification Number has been assigned, the registered person, except those who have been granted registration under rule 12 or, as the case may be rule 16, shall as soon as may be, but not later than forty five days from the date of grant of registration or the date on which the return required under section 39 is due to be furnished, whichever is earlier, furnish information with respect to details of bank account, or any other information, as may be required on the common portal in order to comply with any other provision.”

If the condition is not fulfilled as mentioned above then as per rule 21 of the CGST rules, then their GST registration will get cancelled. Relevant extract of rule 21 is as under:

“21.Registration to be cancelled in certain cases.-The registration granted to a person is liable to be cancelled, if the said person,-

(d) violates the provision of rule 10A”

Thus, it is advisable to complete all the compliances within due time to keep your GST registartion.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.