In this post we shall discuss the steps to Validate UDIN on e-filing portal in Bulk Manner. It is important to note here that if UDIN is not validated on e-filing portal the form submitted will be considered as invalid.

Steps to validate UDIN in bulk are as under:

- Login to e-Filing Portal and then select the e-File menu

- Click on View/Update UDIN Details menu option

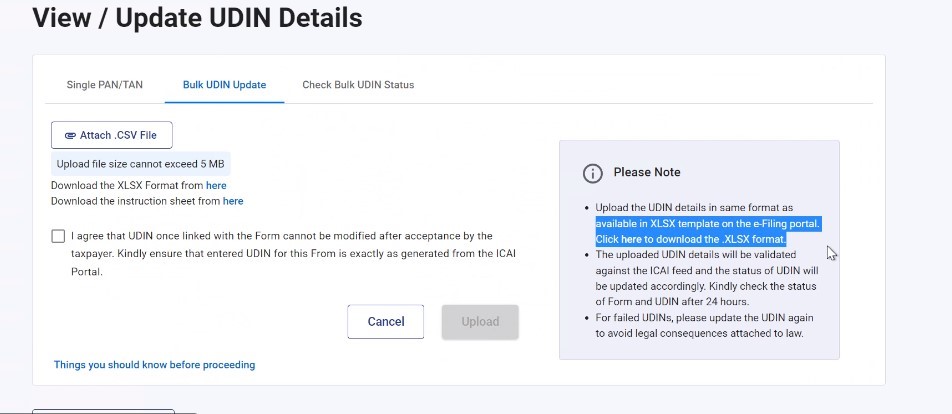

- Click on Bulk UDIN Update tab

- Download the XLSX Format

- Check the date format in your Laptop/ desktop

- Click on Date/ Time shown in the lower right corner of your laptop/ desktop’s screen

- Click on the link – ‘Date and Time Settings’

- Click on the link ‘Date, time and regional formatting’

- Select Country or region as India

Then, go to the section ‘Regional format data’ and check the format for Short Date and Long Date

If these formats are not same as shown in below picture, then click on Change data formats link.

- Change the short date format to DD-MM-YYYY, as shown below

- Select Long date format as DD-Month-YYYY, as shown below and then close the screen.

- Open the XLSX template downloaded from the e-Filing Portal:

- Following columns are mandatory to enter:

- PAN/TAN of the Client

- CA Membership Number

- Form Code

- Filed Date

- Y. / F.Y.

- Acknowledgement number

- UDIN

- After opening the downloaded excel file, fill all the mandatory fields.

- To fill the Form Code, refer the instruction sheet available on Bulk UDIN Update screen, under the link – ‘Things you should know before proceeding’.

- Click on File Option in the menu

- Click on Save As option, select location to save the file and select the format as CSV (Comma delimited) (* .csv)

- Click on SAVE button

- Go to Bulk UDIN Update screen on e-Filing Portal. (Follow steps 1 to 3)

- Upload the saved CSV file. Make sure that the file size does not exceed 5MB size and the file format is .CSV

- Select the declaration and click on Upload

After the file is submitted successfully, you will get a token number. Save that Token number and check the status of file after 24 hours.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for any Income tax related matters CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST related matters CLICK ME.

To book general phone consultation with expert CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 2