Do you use Credit card or let other’s use your credit card for just some rewards or points? Then this article is for you.

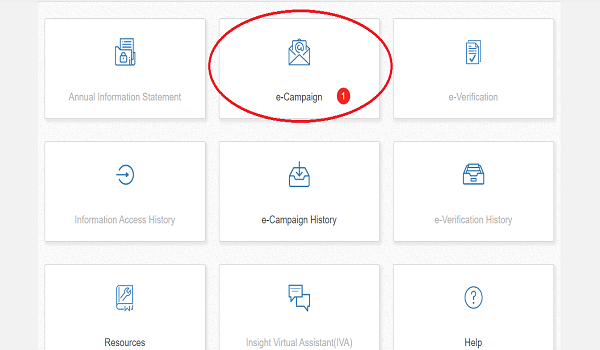

Compliance portal as we know is conducting various algorithms and sending notices to various people be it people who haven’t shown their interest income in ITR or people who have high transaction and have not filed their return of income.

Now slowly and gradually use of credit card is increasing among the youths especially after demonetization and increasing trend on online shopping.

Also, now banks are also offering free credit cards and other facilities to increase purchasing power of people and bring them under debt. Bank also pay some cashback or reward points if people use their credit cards.

You must have seen various online e-commerce operator having special cash back offers for some credit card which again encourages people to use credit cards.

Since many banks are offering free credit cards various people just own a credit card and allow other people to use their credit card whereby they let other people use credit for making purchase and get some cashback or discount and take the amount of purchase in cash from that person.

In today’s time none of bank work is done without linking your PAN with Bank account details and hence all your credit card spend details is available with Income tax department.

Therefore, many people who don’t file income tax return and actually don’t earn much income but have credit card and are just letting people use their credit card for some small rewards and cash amount are in turn receiving notices from Income tax department.

The above notice is being issued to people who haven’t filed their Income tax return but have done transaction on credit over the minimum threshold limit and also repaid the credit card bill and all of these make Income tax department feel that the person is earning above the threshold limit and still not filing his/ her income tax return.

Thus, many people are receiving such notices.

Possible consequences of such transaction could be:

- For non-filing of return late fees of upto Rs. 10,000.

- All the amount could be considered as income of assessee i.e. credit card holder and this could lead to paying tax and interest.

- Since loan i.e. amount paid to cardholder against online purchase, is repaid in cash this could lead to 100% penalty if amount is above Rs. 20,000.

What to do?

Reply to all notices being received within due time or this could lead to assessment proceedings.

Stay in touch with people for whom you have purchased such items.

In future don’t let people purchase on your credit card.

The most important point is to consult a tax expert and discuss your query in detail. If you wish to book consultation CLICK HERE.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)