Many people have reported/ provided a feedback over chat that no such feature has been made available and they are still not able to mention negative figures in GSTR 3B. Hence we decided to mention it in our post itself so that no one is misleaded.

Do let us know whether you are getting to put negative figure or not?

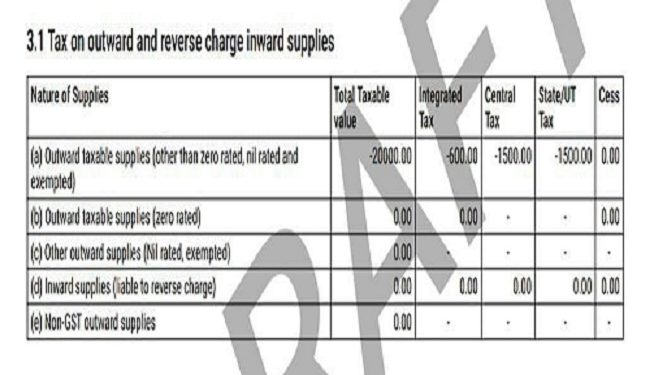

The most awaited feature of GSTR 3B has been enabled by GSTN wherein one can now mention negative figures in Table 3 of GSTR 3B.

Although you still cannot revise GST return or rectify any mistake in the same month of GST return but now atleast you can mention negative figure in GSTR 3B.

This will be very helpful for taxpayers who have more sales return in some month as compared to its sales and hence now they don’t have to wait for next month to adjust those sales return.

It has been said that this feature shall be enable in September month GSTR 3B, we will come to know about the same when we file it.

We will update you on same.

This article is just for information purpose and are personal views of the author. It is always advisable to hire a professional for practical execution or you can mail us. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

We have tried to file returns with negative figures but the system isn’t accepting the negative figures. We tried uploading. JSON file even then the system didn’t accept the return. So, if we could file negative returns then guide us through the process and do send a official notice regarding the negative figures in GSTR-3B.

There is no such official news. It was speculated that they will enable such functionality.

Thank you for informing and spreading awareness that no such facility has been enabled by CBIC.

Regards,

Team Taxontips.com