A few days ago CBIC has launched a facility for Nil filing of GSTR 3B return just by sending an SMS. However same was not available for GSTR 1, now CBIC has launched the same facility for GSTR 1 and here we will discuss as to how you file Nil GSTR 1 in 3 easy steps.

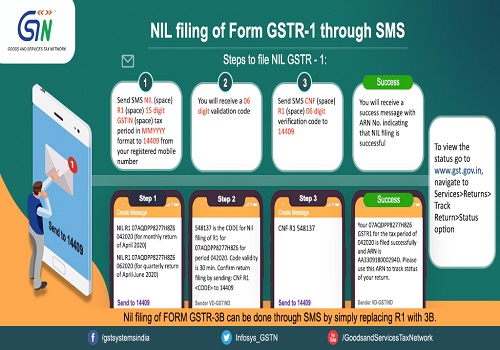

Steps for filing Nil GSTR 1:

Send SMS Nil (space) R1 (space) 15 digit GSTIN (space) tax period in MMYYYY format to 14409 from registered mobile number.

You will receive a 6 digit validation code.

Send SMS CNF (space) R1 (space) 6 digit verification code to 14409.

You will receive a success message with ARN No. indicating that Nil filing is successful.

In case of of tax payers filing GSTR 1 on monthly basis just file return after end of month by mentioning the month for which return is being filed. For eg: for April 2020 return just mention “042020”.

In case of of tax payers filing GSTR 1 on quarterly basis just file return after end of quarter by mentioning the last month of quarter for which return is being filed. For eg: for April-June 2020 return just mention “062020” and file the return after 1st July.

Do remember this will just help you file Nil GST return, however in the begining of every year you will have to go online and select whether you wish to file monthly return or quarterly return.

If you are filing a quarterly GSTR 1 and in 1 month you have sale and in another 2 month you don’t have any sale then also you will have to go online and file the return as it will not be a Nil return.

You can similarly file Nil GSTR 3B just be replacing R1 with 3B.

Thanks for this important information. This is going to be useful for all businesses which are struggling for GST Compliance in this time of crises due to lockdown .

Thank you for the appreciation and it motivates our team to push more such information.

Do subscribe for weekly updates and you can even ask query on Ask an expert tab or book consultation on https://www.taxontips.com/income-tax-return/

Regards,

Team Taxontips.com