As soon as we receive some communication or notice from Income tax department we start to panic even if we haven’t done anything wrong and that’s the normal human behavior.

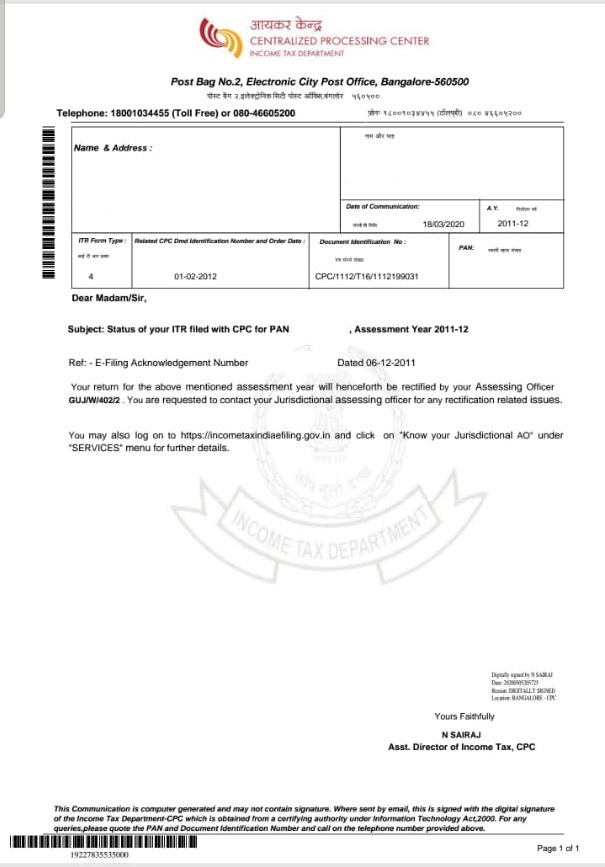

Recently, people have started receiving a notice on their e-mail that

“Your return for above mentioned assessment year will henceforth be rectified by your Assessing officer. You are requested to contact your Jurisdictional assessing officer for any rectification related issues.

You may also logon to incometaxindiaefiling.gov.in and click on “Know your jurisdictional AO” under “SERVICES” menu for further details.”

Now many people are panicked after receiving this notice that how to reply such notice or is their case selected in scrutiny and its not that people are receiving it for recent year. People have been receiving it for AY 2009-10 or 2011-12 also now.

This is just a communication from CPC that if you wish to make any rectification in the return or demand for the year mentioned in the notice you need to now visit AO and not file rectification with CPC as the rights have been transferred.

You can check who is your AO in the path mentioned above and you can go and meet him in the local Income tax office if you have any issues in your return filed for that year and need to make any changes in the return or demand as now he is having the authority to provide permission for such changes.

You don’t have to file any reply for same it’s just a communication and you might receive it if there is a demand outstanding in “For your action” tab for that year or you had filed any rectification for that year or any other reason.

There is no specific thing for which the notices are being sent so no need to worry or think how to reply to such notice.

This article is just for information purpose and are personal views of the author. It is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

Comments 1